The world this week

本周要聞

Business

商業(yè)

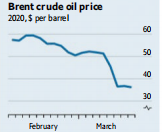

Staggering from the effects of coronavirus on business, stockmarkets were also sent reeling by Saudi Arabia's decision to instigate an oil-price war with Russia, as the pair's agreement over production levels broke down. Oil prices plunged in the sharpest oneday decline since 1991. Saudi Aramco, the state-controlled oil company, is increasing capacity by 1m barrels of oil a day to a record 13m, saturating an already over-supplied market. Trading remained volatile; the decade-long bull run in stockmarkets was deemed to be over.

冠狀病毒疫情對商業(yè)的影響驚人。隨著沙特阿拉伯與俄羅斯有關石油產量水平的協(xié)議破裂,沙特阿拉伯決定挑起與俄羅斯的石油價格戰(zhàn),股市也受到了打擊。油價暴跌,創(chuàng)下1991年以來單日最大跌幅。國有石油公司沙特阿拉伯國家石油公司正將日產量增加100萬桶,達到創(chuàng)紀錄的1300萬桶,使本已供應過剩的市場飽和。交易仍然不穩(wěn)定;股票市場長達十年的牛市被認為已經結束。

Amid the turmoil Saudi Aramco saw its stock fall below 32 riyals ($8.50) for the first time, the price at which the shares were offered when they floated on the stockmarket in December.

在這次動蕩中,沙特阿拉伯國家石油公司的股票首次跌至32里亞爾(8.50美元)以下,該價格是其股票去年12月上市時的發(fā)行價。

The Bank of England made an emergency cut to interest rates, lowering its main rate by half a percentage point to 0.25%. It also extended cheap funding to banks so that they can "bridge a potentially challenging period". The European Central Bank prepared to ease policy and offer a range of supportive actions to companies and banks. The Federal Reserve pumped money into the short-term repo market to support the "smooth functioning of funding markets".

英國央行緊急下調利率,將主要利率下調0.5個百分點至0.25%。它還向銀行提供了廉價資金,使它們能夠“跨越一個可能具有挑戰(zhàn)性的時期”。歐洲央行準備放寬政策,并向企業(yè)和銀行提供一系列支持性行動。美聯(lián)儲向短期回購市場注入資金,以支持“融資市場的平穩(wěn)運行”。

The aviation industry is being battered by the covid-19 outbreak. Boeing lost a fifth of its market value in a day amid reports that it would soon use the remainder of a $13.8bn loan it had only recently secured. Korean Air, which has cancelled 80% of its international flights, said that prolonged disruption threatened its survival. The suspension of many flights, and a general reluctance to travel, has already led to a collapse in bookings, which will be compounded by America's ban on flights from Europe. Chinese airlines have been the worst affected. Chinese passenger numbers tumbled by 85% in February compared with February 2019.

航空業(yè)正因新冠疫情爆發(fā)遭受重創(chuàng)。波音公司的市值在一天內蒸發(fā)了五分之一,同時有報道稱,該公司很快將動用最近才獲得的138億美元貸款的剩余資金。大韓航空公司已經取消了80%的國際航班。該公司表示,持續(xù)的航班中斷威脅到它的生存。許多航班停飛,以及人們普遍不愿出行的情況,已經導致了機票預訂量的大幅下降,而美國對歐洲航班的禁令將使這一情況雪上加霜。中國航空公司受到的影響最為嚴重。與2019年2月相比,今年2月中國乘客數量下降了85%。

India's central bank stepped in to rescue Yes, the country's fourth-largest private lender, which is grappling with high debt. The bail-out involves State Bank of India, the biggest government-owned bank, taking a stake in Yes.

印度央行出手救助該國第四大私人銀行“Yes銀行”,后者正在艱難應對高額債務。印度最大的國有銀行印度國家銀行將入股“Yes銀行”。

Jamie Dimon, the chief executive of JPMorgan Chase, had an emergency procedure on his heart, leaving two senior executives in charge until he recovers. Mr Dimon has run the company since 2005, making him the longest-serving CEO of any big American bank.

摩根大通公司首席執(zhí)行官杰米·戴蒙做了緊急心臟手術。在他康復前,兩名高管將負責管理公司。自2005年以來,戴蒙一直掌管著摩根大通,這使他成為美國所有大型銀行中任職時間最長的首席執(zhí)行官。

譯文為可可英語翻譯,未經授權請勿轉載!