London's insurance market

倫敦保險市場

Risky business

為風險投資

London's position as world-leader in insurance is under threat

倫敦在保險市場的老大地位受到威脅

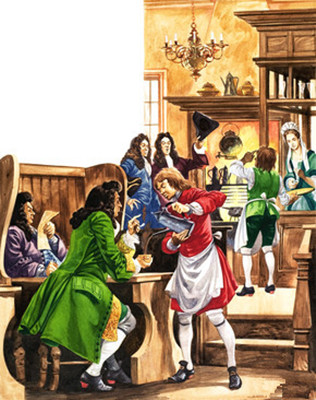

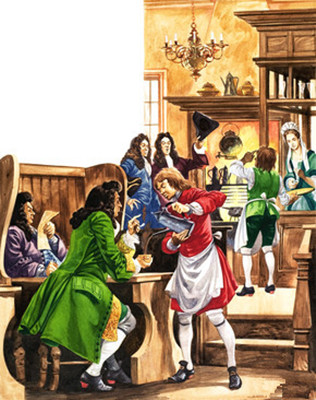

FROM the doomed Titanic, an ocean liner (1m), to the legs of Cristiano Ronaldo, a footballer (144m), some of the biggest and most unusual risks have been taken on by the London insurance market, the oldest and largest in the world. Started more than 300 years ago in a coffee shop in Tower Street run by Edward Lloyd, the market was first thought up to share the hazards of mercantile trading adventures. It grew with the empire.

難逃劫數的遠洋客輪泰坦尼克號(保險額1百萬美元)和克里斯蒂亞諾·羅納爾多的一條腿(保險額1億4千4百萬美元),分別是歷史最悠久,規模最大的倫敦保險市場上投保最大和最特別的例子。發跡于300年前塔街愛德華·勞埃德(Edward Lloyd)的咖啡館,保險最初是為了分擔商業貿易的風險。保險隨著大英帝國的崛起而紅火起來。

Cyber-risk wasn't a problem for Mr Lloyd

網絡風險對于勞埃德來說并不成問題

Today, the sector employs 48,000 people, makes up 21% of the City's economy and underpins global industries like aviation (57% of whose insurance is underwritten in London) and shipping (33%). One tenth of global commercial insurance and 13% of reinsurance is underwritten in London, making the market roughly the same size as its three closest rivals—Bermuda, Singapore and Zurich—combined.

現在,有4800人在保險行業工作,保險行業占倫敦經濟的21%,支撐著像航空(57%的保險都在倫敦承保)和航運(33%)等全球產業。全球商業保險的十分之一以及再保險的13%都在倫敦承保,使得倫敦的保險業務規模達到了其最接近的三個對手—百慕大、新加坡和蘇黎世—保險業務之和。

However, a study published on November 10th by the London Market Group, which represents the industry, and Boston Consulting Group, a consultancy, says London's dominant position is under threat. While the rest of the City was forced to reform in recent decades, the insurance industry has remained largely unchanged. The report reckons as much as 40% of London's current insurance business is now at risk of going elsewhere.

但是,11月10日,作為保險業顧問的波士頓咨詢集團和倫敦市場研究小組聯合發布的調查結果聲稱倫敦保險業的主導地位正受到威脅。當倫敦的其他行業在近幾十年來被迫改變的時候,保險業卻基本一成不變。這份報告估計多達40%的倫敦現有保險業務將會流向別處。

Emerging markets accounted for 43% of world growth in the commercial insurance industry over the past three years—the Chinese market alone grew by 18% annually over that period. Yet London only managed to capture 0.5% of that growth. Its share of emerging markets fell to 2.5% in 2013 from 3.2% in 2010. The London market is also losing out to competitors in reinsurance (the insurance of insurers), where its share has fallen from 15% to 13% and is expected to drop further. The big threats here come from new market entrants (such as hedge funds) and expanding competitors such as Bermuda (whose reinsurance grew by 5%) and Singapore (10%).

在過去三年里,新興市場在全球商業保險增長率中占有43%——僅中國市場就以每年18%的速度增長。但是倫敦卻僅僅只占全球增長的0.5%。倫敦市場在新興市場中的份額由2010的3.2%下降到2013年的2.5%。倫敦市場在再保險業務(保險人的保險)方面也輸給了競爭對手,其再保險業務從市場中的15%下降到13%,據預計這個還會進一步下降。最大的威脅來自于市場的新進入者(比如對沖基金)和不斷擴張的競爭對手比如百慕大(再保險業務增長了5%)和新加坡(10%)。

Perhaps the biggest challenge lies in finding solutions for new types of corporate risks. These include reputation- and cyber-risk. The insurance industry has failed to keep up with changing business needs and some chief executives say that as much as 90% of their corporate risks are currently not insurable, because nobody has come up with the right products.

或許最大的挑戰來自為新型企業風險尋找不一樣的解決方案。這些風險包括企業聲譽和來自網絡的風險。保險業未能跟上不斷變化的商業需求,一些首席執行官說因為保險業的滯后,沒有人提出合適的方案,90%的企業風險目前都不能投保。

The industry remains strangely old-fashioned. Only 35% of its workforce have a university degree, compared with 60% for the workforce in central London. It has also failed to compete on cost, with burdensome regulations and higher transaction costs adding up. Investors are pouring new capital into the wider insurance market. Customers have plenty of choice.

保險業依舊是奇怪的老樣子。從事保險業的員工僅有35%擁有大學學位,而在倫敦中心工作的人擁有大學學位的比例達到了60%。繁重的規章制度加上越來越高的交易成本使得保險業在成本方面也落后于其他行業。投資者把資本投向更廣闊的保險市場。客戶也有更多的選擇。

There is plenty London could do to improve, says the report. It needs to shift its focus to emerging markets and to high growth sectors. It also needs to lead the way in adopting the latest technological innovations to measure and predict risk. There have been great advances in telematics, for example. One device is a box increasingly used in cars to assess individual drivers' behaviour, which makes it easier to assess the risk of insuring them. Mr Lloyd might have approved of such radical innovation.

報告還稱倫敦保險業還可以做很多改變。它需要將重心轉移到新興市場和高增長領域。它還需要引領科技潮流,采用最新科技創新來計算和預測風險。例如已經在遠程信息處理上取得的重大進步,一個盒子外形的裝置被逐漸應用到汽車上,使得評估投保人風險變得更加容易。勞埃德已經批準了這一突破性的創新。譯者:胡雅琳 校對:崔夢雪