The People’s Bank of China set the daily fix 0.51 per cent weaker today, after the onshore currency rate weakened 0.6 per cent on Wednesday to its weakest level since March 2011.

中國(guó)央行今日將人民幣兌美元匯率中間價(jià)調(diào)低0.51%。周三,在岸人民幣匯率下跌0.6%,跌至2011年3月以來(lái)的低點(diǎn)。

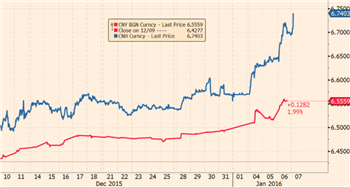

The PBoC set the fix at 6.5646 per dollar, an eighth consecutive softening and the biggest such move since August, when the currency was suddenly devalued. On Wednesday the onshore exchange rate, CNY, fell to 6.5559 per dollar.

中國(guó)央行將人民幣兌美元匯率中間價(jià)設(shè)定在1美元兌6.5646元人民幣,這是它連續(xù)第八日下調(diào)人民幣匯率中間價(jià),也是去年8月人民幣突然貶值以來(lái)中國(guó)央行作出的最大一次調(diào)整。周三,在岸人民幣匯率下跌至1美元兌6.5559元人民幣。

Before the fix was set, the offshore rate – China’s exchange rate outside of the mainland, which was introduced in 2010 – depreciated 0.1 per cent to 6.7040, indicating market pressure for the central bank to set the fix lower. On Wednesday the offshore rate breached 6.7 for the first time in five years, before ending the session 0.78 per cent weaker at 6.6964 per dollar.

在今日人民幣匯率中間價(jià)設(shè)定之前,離岸人民幣匯率下跌0.1%至1美元兌6.7040元人民幣,顯示出市場(chǎng)正在施壓中國(guó)央行下調(diào)人民幣匯率中間價(jià)。周三,離岸人民幣匯率五年來(lái)首次跌破1美元兌6.7元人民幣,后收跌至1美元兌6.6964元人民幣,跌幅為0.78%。

Just after the fix was set, CNH depreciated another 0.8 per cent to 6.7514 per dollar.

在今日中間價(jià)設(shè)定后不久,離岸人民幣匯率又下滑了0.8%,至1美元兌6.7514元人民幣。