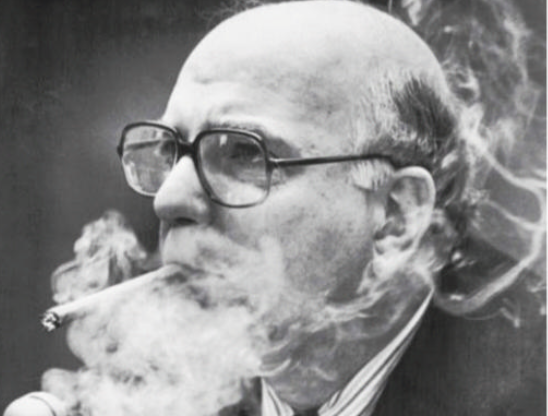

Paul Volcker, chairman of the Fed and America's doughtiest inflation-fighter, died on December 8th, aged 92

保羅·沃爾克是美聯(lián)儲主席和美國最勇猛的通貨膨脹斗士,他于12月8日去世,享年92歲。

In his spells of leisure time, when he had any, Paul Volcker liked to go fishing. Towering above a river in his jerkin and waders, fly cast, cigar firmly in mouth, was a good way to ruminate on big decisions. And he believed in rumination. "Procrastinate and flourish" was a favourite motto. Another, from George Washington, which his father had kept above his desk when he was city manager of Teaneck, New Jersey, was: "Do not suffer your good nature...to say yes when you ought to say no."

From then on the Fed would control not the price of money, by adjusting the interest rate, but its supply, leaving interest rates to be set by the market. He would force America into recession to cure people of their expectations that since prices would keep on rising, they must keep on spending. The downturn that followed—double-dip, because he briefly took his foot off the brake—brought soaring unemployment, reaching 10.8% in 1982, and a federal funds rate of over 20%, the highest in history, before both rates and prices eased. By 1983 inflation was less than 4%. Yet he had been ruminating about the beast, and how to subdue it, since his Princeton student days.

譯文由可可原創(chuàng),僅供學(xué)習(xí)交流使用,未經(jīng)許可請勿轉(zhuǎn)載。