Commerzbank

德國商業銀行

Das slog

步履維艱

The second-biggest bank in Europe's strongest economy still faces an uphill task

歐洲最強經濟體的第二大銀行仍然面對提高業績任務。

Jul 27th 2013 | Berlin |From the print edition

COMMERZBANK'S marketing materials show a woman running in a grey, hooded jumper, headphones in her ears. Her eyes are locked on the path ahead in determination to finish her workout. This is probably meant to flatter the bank's customers as gritty and hard-working. But it is a better metaphor for the bank itself. It is on a long, hard road back to health, a journey that exemplifies the painful reshaping of Europe's troubled banking system to be smaller, safer and more domestic.

德國商業銀行的營銷材料上畫著一名女子,身穿灰色衣服跑步,帶著連衣帽,耳朵里塞著耳機。眼神堅毅,死死盯著前方的路,志在完成自己的鍛煉計劃。這可能是在討好自己的客戶,暗指他們都是堅韌不拔,工作勤奮。但是這個隱喻或許更貼合銀行自身的實際。德國商業銀行離回到良性發展還有很長的路。這是歐洲陷入危機的銀行體系轉向更小,更安全和更本土化的痛苦轉型的很好的例證。

Commerzbank's initial trajectory through the crisis resembles that of another European lender, Britain's Lloyds Banking Group (LBG). Like LBG, it was a big bank but not the biggest in the country—Deutsche Bank is Germany's colossus. Like Lloyds, it undertook a disastrous domestic transaction at the worst possible time, buying Dresdner Bank in the summer of 2008 just weeks before LBG gobbled up HBOS. And like the British bank, it quickly ended up tapping state coffers to survive.

德國商業銀行度過危機的初始軌跡很想另一家歐洲銀行,英國的勞埃德斯銀行集團。跟勞埃德斯一樣,德國商業銀行是本國的一家大型銀行,但卻不是最大的,德國最大的銀行是德意志銀行。德國商業銀行同樣經歷了一次災難性的國內收購。它在2008年夏天買下了德累斯頓銀行,這是在勞埃德斯吞并蘇格蘭哈利法斯克銀行幾周之后。同樣的,很快以向國庫求救自保結束。

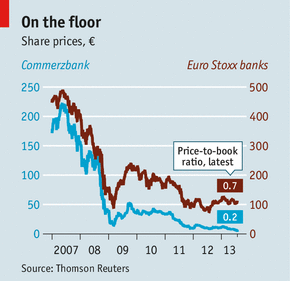

The parallels between the two are less obvious now. LBG's shares have risen by 33% in the past three months, and by 133% in the past year. The bank's share price hovers just below the price the British government paid to buy its 39% stake, which will soon be sold. Things look far less fizzy at Commerzbank. At the time of the rescue deal the bank's boss, Martin Blessing, declared that state ownership should last a maximum of 36 months. More than four years on, its shares still lag the broader index of European banks; its price-to-book ratio is one of the lowest on the continent (see chart). Its 2012 net profit came in at a mere 6m euros(7.7m dollars).

兩者現在的處境有所不同。勞埃德斯的股價在過去的三個月中上漲了33%,在去年上漲了133%。該銀行的股價稍稍低于英國政府購買其39%股份時的價格,英國政府很快就會將這筆股份賣掉。德國商業銀行的處境則要慘得多。德國政府救助與其交易的時候,銀行老板Martin Blessing說,國有權最多持續36個月。而現在,四年過去了,其股價仍舊低于歐洲銀行的大盤指數。其市凈率在歐洲處于最低水平。而在2012年的凈利潤也只有600萬歐(770萬美元)。

Rumours that the German government might sell its 17% stake to a foreign bank were scotched this week. Newspapers speculate whether the bank might exit the DAX, the country's benchmark stockmarket index, leaving Deutsche as the only member bank. Deutsche itself still labours to plump up its own thin capital cushion.

本周,德國政府出售其控股的17%給一家外國銀行的謠言四起。媒體紛紛推測德國商業銀行會不會退出德國DAX指數,這樣該指數就只剩德意志銀行一家銀行股了。德意志銀行也忙著增加其緩沖資金。

Commerzbank can point to several forces beyond its control. The euro-zone crisis weighs heavily. The restructuring of Greek government debt handed it a big loss. Historically low interest rates have depressed income. Competition from Germany's many small savings banks and co-operatives puts pressure on fees; online banks are adding to the pressure. A downturn in shipbuilding has hit Commerzbank's big portfolio of loans in that industry. The Basel 3 rules have prompted the bank to retain capital rather than dole it out to shareholders. (The bank estimates that its Tier-1 core capital ratio under Basel 3 is 8.4% after a May capital-raising.)

德國商業銀行能將原因歸咎于幾個它無法控制的因素。歐元區危機無疑是最大的因素。希臘政府債務重組給其造成了重大損失。史上最低的利率也減少了其收入。來自德國的許多小型儲蓄銀行的競爭也使其降低自身費用,網上銀行也增加了其壓力。造船業的衰退也使得其在造船業德組合貸款業務受到沉重打擊。巴塞爾3資本規定使得德國商業銀行只能保留資本,而不能發放給股東。(銀行估計,在巴塞爾3規定下,其一級核心資本比率在五月融資之后達到8.4%)

For one bank to have had so much bad luck prompts the question of just how much carelessness, not misfortune, is to blame. Like many European banks, both Commerzbank and Dresdner invested in subprime-mortgage-backed assets before the crisis. And like many of its continental peers, the bank was also a big international lender against chunky assets in areas like shipping, aviation and property. About a quarter of its 18.3 billion euros shipping portfolio is non-performing; it is expected to take a charge against lending in Detroit when it next reports results.

對于一家銀行來說,這么多倒霉事兒遇到一起,只能怪其太粗心,而不能說太不幸了。跟許多其他歐洲銀行一樣,德國商業銀行和德累斯頓銀行在危機之前都投資了次貸資產。這個銀行也借貸給船舶業,航空業和房地產業。其在船舶業投資達183億歐,其中有四分之一毫無收益,等下次報告出來該行有可能向底特律的借貸提起指控。

Analysts want Commerzbank to keep shedding these “non-core” assets, which stood at 151 billion euros at the end of 2012. Some are easier to offload than others. Holdings of peripheral euro-zone government bonds can be gently unwound by letting them run off. But shipping and property loans are longer-term and less liquid, which is why they are now being treated more harshly under the Basel 3 rules. Commerzbank did this month at last manage to sell the British operations of EuroHypo, its commercial-property arm.

分析員希望德國商業銀行能放棄非核心資產,這些在2012年底占到1510億歐。有些很容易脫手。所持歐元區其他國家政府的債券會輕微受損。但是船舶業和房地產業的貸款是長期的,流動性也差,這也是在巴塞爾3規則下更嚴厲的原因。德國商業銀行這個月末最終準備賣掉歐洲抵押銀行的英國公司,其商業地產分支。

As Commerzbank slims down these parts of its balance-sheet, a more Germanic lender is slowly emerging. The strategy is plausible. The combination with Dresdner gave Commerzbank an enviably big retail-branch network and customer base in Europe's strongest economy. The Mittelstandsbank, the division lending to Germany's small and medium-sized, mostly family-owned businesses, is in decent health: 30% of Mittelstand companies are customers, and the pre-tax return on equity in this unit was 28.6% in 2012, against 3.1% for the group overall. As these firms go into global markets, where savings banks cannot follow, Commerzbank has a shot at boosting its business with them. Expansion in Poland looks sensible.

隨著德國商業銀行將這些從資產負債表中除去,一個更德國的借貸者出現了。這個戰略看起來是有效的。跟德累斯頓銀行的合并會使得德國商業銀行在歐洲最強經濟體擁有一個令人羨慕的大型零售網絡和顧客基礎。中小企業銀行掌管德國的中小企業貸款業務,這些中小企業中很多都是家族企業,2012年,這一業務的稅前回報為28.6%,整體業務只有3.1%的回報。隨著這些企業的國際化,儲蓄銀行就無能為力了。德國商業銀行有意拓展跟他們的業務。在波蘭的擴張看起來很有用。

Yet the bank is still some way from turning this vision into reality. A banking consultant quips that the maths of the Dresdner deal amount to “one plus one equals one”. And a domestic focus has its downsides. Fierce local competition from the savings banks and co-operatives will not go away. Nor will the drag from the euro zone's economic prospects: interest rates will remain low as long as inflation stays subdued.

然而,德國商業銀行還是應該回到現實。一個銀行業顧問指出,這次的德累斯頓交易是一次虧本買賣。國內的重點業務呈下降趨勢。來自儲蓄銀行的激烈的本地競爭不會停止。歐元區的經濟預期是只要通貨膨脹得到抑制,利率將會持續走低。這也會拖累銀行復興。

So Mr Blessing and his team have little choice but to concentrate on the nuts and bolts. That includes making more cuts in branches and staff (branches have already fallen from about 1,500 to 1,200), controlling their tempo so that the bank can reap savings without battering its franchise. One part of this is greater flexibility in the offerings at each branch. Not every location needs an expert in everything; more advice can be given online or over the phone. Another is growth in its online division, comdirect. Commerzbank has the scale to build a sophisticated offering; savings banks and co-operatives may not.

因此,Blessing先生跟他的團隊沒有多大選擇,只能是集中精力做好細節工作。包括減少分支機構,裁員(分支機構已經從1500個減少到1200個了),控制好節奏,只有這樣銀行才能從存款中獲利,并且不影響其經營。這在各分支有很大的靈活性。不是每個地方都需要專家,可以通過電話或者網絡提供建議。還有一個是網上分支的增加。德國商業銀行能提供各種復雜的服務,但是儲蓄銀行則不能。

Such strengths should eventually return Commerzbank to fitness. But the miserable share price suggests that investors expect a period of plodding before it is back to running at full tilt.

這些措施應該最終能使得德國商業銀行回到正軌。但是其可憐的股價意味著投資者期望其走出困境之前有一段時間的辛勤工作。