Finance and Economics; Free exchange; Body of evidence;

財經�����;自由交流專欄���;關于金融危機的大量證據���;

Is a concentration of wealth at the top to blame for financial crises?

金融危機是否應歸咎于財富向上層的集中����?

In the search for the villain behind the global financial crisis, some have pointed to inequality as a culprit. In his 2010 book “Fault Lines”, Raghuram Rajan of the University of Chicago argued that inequality was a cause of the crisis, and that the American government served as a willing accomplice. From the early 1980s the wages of working Americans with little or no university education fell ever farther behind those with university qualifications, he pointed out. Under pressure to respond to the problem of stagnating incomes, successive presidents and Congresses opened a flood of mortgage credit.

全球金融危機的幕后黑手究竟是誰�����。各方對此問題的調查從未停止過�����,其中就有一種觀點認為,收入不平等是造成危機的罪魁禍首。芝加哥大學的拉古拉邁·拉詹教授在他2010年出版的《斷層線》一書中說,引發危機的主犯是收入不平等,而政府則充當了心甘情愿的幫兇角色���。他指出,自1980年代初起,美國勞動者的收入出現了兩極分化�,未受過高等教育的人的工資遠低于擁有大學學歷者�����,而且二者的差距還在擴大。民眾收入停滯不前成了歷任政府和國會都頭痛不已的老大難問題,迫于現實壓力��,他們作出了放開抵押貸款限制的決定���。

In 1992 the government reduced capital requirements at Fannie Mae and Freddie Mac, two huge sources of housing finance. In the 1990s the Federal Housing Administration expanded its loan guarantees to cover bigger mortgages with smaller down-payments. And in the 2000s Fannie and Freddie were encouraged to buy more subprime mortgage-backed securities. Inequality, Mr Rajan argued, prepared the ground for disaster.

1992年�,政府降低了對房利美和房地美的資本要求,這兩家公司都是住宅信貸市場上的主要資金供給者��。在1990年代,美國住房管理局放松了向借款人提供抵押擔保的條件,將更多的小額首付抵押貸款也納入了其覆蓋的范圍。進入2000年后��,房地美和房利美在有利形勢的鼓舞下購買了更多的次級住房抵押貸款證券���。此后����,收入不均的土壤里便結出了災難的果實����,拉詹如此說道

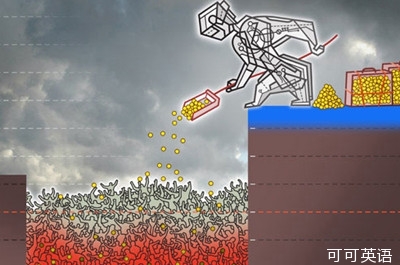

Mr Rajan's story was intended as a narrative of the subprime crisis in America, not as a general theory of financial dislocation. But others have noted that inequality also soared in the years before the Depression of the 1930s. In 2007 23.5% of all American income flowed to the top 1% of earners—their highest share since 1929. In a 2010 paper Michael Kumhof and Romain Rancière, two economists at the International Monetary Fund, built a model to show how inequality can systematically lead to crisis. An investor class may become better at capturing the returns to production, slowing wage growth and raising inequality. Workers then borrow to prop up their consumption. Leverage grows until crisis results. Their model absolves politicians of responsibility; inequality works its mischief without the help of government.

拉詹只是講述了美國次貸危機事件的經過,他并沒有針對金融紊亂提出某種可供解釋的一般性理論。但是有人注意到�,在1930年代大蕭條爆發前夕的那些年��,收入不平等的程度急劇上升。在2007年,占美國人口1%的最富裕人群吸收了當年全國收入的23.5%——這一比例是自1929以來的達到的最高點。2010年��,兩位來自國際貨幣基金組織的經濟學家邁克爾·科夫和羅曼·朗西埃在一篇論文中構建了一個模型�,顯示了收入不平等是如何系統性地導致了危機的產生。投資者階層越來越善于獲取生產性收益、減慢工人工資增長速度�,從而提高收入了收入不平度程度��。工人們只得依靠借款來維持消費。信貸杠桿不斷上升,直至以危機爆發而告終。該模型假設政治家不負擔監管的責任;在沒有政府介入的前提下,收入不均會產生各種危害��。

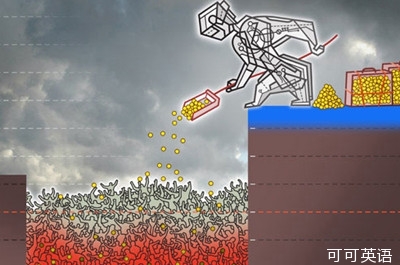

New research hints at other ways inequality could spur crisis. In a new paper* Marianne Bertrand and Adair Morse, both of the University of Chicago, study patterns of spending across American states between 1980 and 2008. In particular, they focus on how changes in the behaviour of the richest 20% of households affect the spending choices of the bottom 80%. They find that a rise in the level of consumption of rich households leads to more spending by the non-rich. This “trickle-down consumption” appears to result from a desire to keep up with the Joneses. Non-rich households spend more on luxury goods and services supplied to their more affluent neighbours—domestic services, say, or health clubs. Had the incomes of America's top 20% of earners grown at the same, more leisurely pace as the median income, they reckon that the bottom 80% might have saved more over the past three decades—$500 per household per year for the entire period between 1980 and 2008, or $800 per year just before the crisis. In states where the highest earners were wealthiest, non-rich households were more likely to report “financial duress”.

最新研究表明�,不平等還會以其他方式刺激危機發生。芝加哥大學的瑪麗安·伯特蘭和阿戴爾·莫爾斯最近發表的一篇論文研究了1980——2008年間美國各州的消費模式���。他們特別關注了美國人中最富有的20%人群的行為變化如何到影響底層80%人群的消費決策。他們發現�,富裕家庭消費水平的提高會引起非富裕家庭開支的增加����。人們想要與收入地位相等者進行攀比的心態似乎引發了“涓滴型消費”現象的出現���。非富裕家庭在他們那些有錢鄰居的影響下會購買更多的奢侈物品和服務——比方說����,國內航線或健身俱樂部等���。他們估計����,過去的三十年里�����,如果美國收入最高的20%人群的收入增速放緩到像中等收入者一樣的水平����,底層的那80%人群可能就會更多地進行儲蓄——從1980到2008年,每年每戶家庭能存500美元����,到危機爆發前夕����,每年儲蓄的金額會上升到800美元����。研究表明,在那些收入最高者同時也是最富裕人群的幾個州中���,非富裕家庭表現出“金融脅迫”癥狀的可能性更高��。

The paper also reveals how responsive government is to rising income inequality. The authors analyse votes on the credit-expansion measures cited in Mr Rajan's book. When support for a bill varies, the authors find that legislators representing more unequal districts were significantly more likely to back a loosening of mortgage rules.

這篇論文同時也揭示了政府如何應對不斷加劇的收入不均問題���。兩位作者分析了拉詹書中介紹的各種有關信貸膨脹措施法案的投票情況����。他們發現越是來自收入不均地區的立法者�����,越是傾向于給放松抵押貸款政策投贊成票。

Inequality may drive instability in other ways. Although sovereign borrowing was not a direct contributor to the crisis of 2008, it has since become the principal danger to the financial system. In another recent paper Marina Azzimonti of the Federal Reserve Bank of Philadelphia, Eva de Francisco of Towson University and Vincenzo Quadrini of the University of Southern California argue that income inequality may have had a troubling effect in this area of finance, too.

收入不平等還可能引起其他方面的混亂�。盡管主權債務沒有直接導致2008年的金融危機,但是現在它已成為維護金融系統穩定的頭號大敵�����。費城聯邦儲備銀行的瑪麗娜·阿茲莫提�、陶森大學的伊娃·德·弗朗西斯科以及南加州大學的文森佐·夸德里尼在最近合作發表的一篇論文中指出����,收入不平等可能會給主權債務這一金融領域造成不小的麻煩�����。

The authors' models suggest that a less equitable distribution of wealth can boost demand for government borrowing to provide for the lagging average worker. In the recent past this demand would have coincided with a period of financial globalisation that allowed many governments to rack up debt cheaply. Across a sample of 22 OECD countries from 1973 to 2005, they find support for the notion that inequality, financial globalisation and rising government debt do indeed march together. The idea that inequality might create pressure for more redistribution through public borrowing also occurred to Mr Rajan, who acknowledges that stronger safety nets are a more common response to inequality than credit subsidies. Liberalised global finance and rising inequality may thus have led to surging public debts.

他們的模型顯示����,一個有欠公平的財富分配機制會推高政府的借款需求。政府再將籌集的借款轉移給低收入群體��。在過去數年���,政府的借款需求的上升恰好伴隨著金融全球化的進行,這使得許多政府能夠得以低廉的成本發行債券。在一份包括了22個OECD國家從1973年到2005年間數據的樣本中,他們發現收入不均���、金融全球化以及政府債務的上升確實處于同一步調中��。拉詹也意識到了收入不平等會通過增加公共借款的形式進行財富的再分配���。他認為政府在應對收入不平等問題時,合理的反應應該是加強社會安全網�,而非鼓勵信貸補貼����。全球金融自由化和收入不平等的加劇可能是導致公共債務上升的原因��。

Other economists wonder whether income inequality is not wrongly accused. Michael Bordo of Rutgers University and Christopher Meissner of the University of California at Davis recently studied 14 advanced countries from 1920 to 2008 to test the inequality-causes-busts hypothesis. They turn up a strong relationship between credit booms and financial crises—a result confirmed by many other economic studies. There is no consistent link between income concentration and credit booms, however.

經濟學家中持不同觀點者則懷疑收入不平等是否真應擔此惡名����。羅格斯大學的邁克爾·波爾多和加州大學戴維斯分校的克里斯托弗·麥斯納研究了14個發達國家從1920年到2008年的有關的數據,對不平等引起破產的假設進行檢驗�。他們得出的結論是����,信貸繁榮與金融危機之間存在著強相關性——許多經濟研究已經證實了這一點���。然而,收入集中和信貸繁榮之間不存在任何聯系�����。

Inequality occasionally rises with credit creation, as in America in the late 1920s and during the years before the 2008 crisis. This need not mean that the one causes the other, they note. In other cases, such as in Australia and Sweden in the 1980s, credit booms seem to drive inequality rather than the other way around. Elsewhere, as in 1990s Japan, rapid growth in the share of income going to the highest earners coincided with a slump in credit. Rising real incomes and low interest rates reliably lead to credit booms, they reckon, but inequality does not. Mr Rajan's story may work for America's 2008 crisis. It is not an iron law.

收入不平等偶爾會伴隨著信貸擴張而產生�,美國在1920年代末和2008年就經歷了這種情況��。波爾多和麥斯納注意到���,這并不意味著不平等與信貸之間存在著因果關系��。在有的情況中,信貸繁榮似乎反倒引起了收入不平等的加劇����,比如1980年代的澳大利亞和瑞典就有這種情形的發生����。在1990年代的日本�,收入快速集中到高收入者手中的同時,信貸卻在萎縮�。他們估計����,實際收入的上升和較低的利率導致了信貸的繁榮�����,收入不平等并非誘因。拉詹的的理論或許很好地解釋了美國2008年的金融危機,但它并非任何條件下都適用�。