Finance and Economics;The Big Mac index;Calories and currencies;

財(cái)經(jīng);巨無霸指數(shù);貨幣卡路里;

What burgernomics says about five years of turmoil

漢堡經(jīng)濟(jì)學(xué)解讀“危機(jī)五年”

Our Big Mac index is back. Normally a beefy bundle of exchange rate fun, this year it is marking a sombre anniversary: five years since global money-markets seized up in the summer of 2007. What does burgernomics reveal about today's exchange rates, and about the impact that five years of distress, from credit crunch to euro crisis, have had on currencies?

《經(jīng)濟(jì)學(xué)人》的巨無霸指數(shù)又回來啦!與往常拿厚厚一疊匯率開玩笑不同,今年是為了黯然紀(jì)念“2007年夏全球金融市場失靈”五周年。漢堡經(jīng)濟(jì)學(xué)該如何解讀現(xiàn)今的匯率形勢,以及五年混亂——從信貸緊縮到歐元危機(jī)對貨幣的影響?

The Big Mac index is The Economist's burger-based measure of whether currencies are over- or undervalued. The recipe comes from the theory of purchasing-power parity, which says that exchange rates should eventually adjust to make the price of a basket of goods the same in each country. Our basket contains just one item: the Big Mac hamburger, which is pretty much the same around the world.

巨無霸指數(shù)是《經(jīng)濟(jì)學(xué)人》以漢堡價(jià)格為基礎(chǔ)來衡量一國貨幣是否被高估或低估。其理論依據(jù)是購買力評價(jià)學(xué)說,該學(xué)說認(rèn)為應(yīng)使匯率最終調(diào)整到使各國一籃子商品的價(jià)格相同。《經(jīng)濟(jì)學(xué)人》的籃子里只有一樣商品:巨無霸漢堡,該商品在全世界賣的幾乎是一樣的。

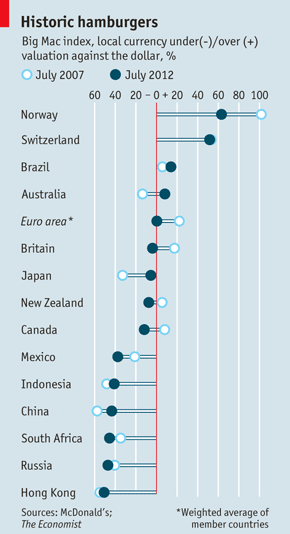

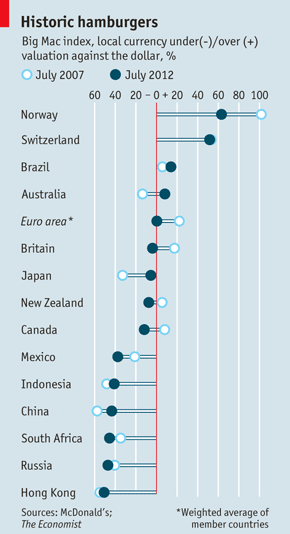

The index works by calculating the exchange rate that would leave a Big Mac costing the same in each country. Take the rouble and the real, the currencies of Russia and Brazil respectively. At current exchange rates a Big Mac, which sells for 4.33 dollor in America, costs just 2.29 dollor (75 roubles) in Russia, whereas in Brazil it sells for a sliver under 5 (10 reais) dollor. So the dollar buys a lot of burger in Russia, signalling that the rouble is cheap and the real rather pricey. A selection of other currencies is included in the chart (the full index can be seen here).

巨無霸指數(shù)的作用在于計(jì)算出使各國漢堡價(jià)格相同的匯率。以俄羅斯貨幣盧布和巴西貨幣雷亞爾為例。在當(dāng)前匯率下,一個巨無霸在美國售價(jià)為4.33美元,在俄羅斯僅售2.29美元(75盧布),然而巴西的售價(jià)略低于5美元(10雷亞爾)。所以美元在俄羅斯可以買到許多漢堡,這說明盧布比較便宜而雷亞爾相當(dāng)昂貴。該圖表顯示了其他代表性貨幣情況(要看完整的巨無霸指數(shù)請點(diǎn)這里)

In addition to the real, several other currencies look dear, according to the latest Mcdata. A group of rich European countries—none of them in the euro zone—sit near the top of the pile. At the other end, the yen, the pound and the Canadian dollar all look cheap. But it is in Asia that you get the most burger for your buck: China, Indonesia and Hong Kong are all more than 40% undervalued.

根據(jù)美國麥迪數(shù)據(jù)公司最新數(shù)據(jù)顯示,除了雷亞爾,其他幾種貨幣也表現(xiàn)得昂貴。一批富裕的歐洲國家——都沒有加入歐元區(qū)——處在排行的前列。另一端,日元、英鎊、以及加拿大元都表現(xiàn)的廉價(jià)。然而在亞洲買漢堡才是最劃算:中國、印度尼西亞、和中國香港的貨幣都低估了40%以上。

There have been some big shifts in fortune since the first rumblings of the crisis, five years ago. The Australian dollar has strengthened, moving from 14% undervalued to 8% overvalued. In the early part of the crisis Australia's well-capitalised banks proved remarkably resilient; more recently, the currency has benefited from a spike in commodities prices (see article), and from strong exports to China. Japan and Brazil also have beefier currencies than five years ago.

自五年前經(jīng)濟(jì)危機(jī)伊始,全球財(cái)富進(jìn)行了一些大洗牌。澳元走強(qiáng),從低估40%升至高估8%。在危機(jī)早期,澳洲資本雄厚的銀行顯著地證明了自己具有彈性。最近,澳元又受益于大宗商品價(jià)格飆升,以及對中國強(qiáng)勁的出口。日本和巴西的貨幣也比五年前更堅(jiān)挺。

Others have weakened. The British pound is a shadow of its former self: since 2007 it has moved from 18% overvalued to 4% undervalued. Britain's experience has been the opposite of Australia's: its financial industry, a big chunk of the overall economy, was at the heart of the financial turmoil (the pound depreciated sharply in 2008) and its biggest export market, the euro zone, is in a dreadful mess.

其他貨幣則變得疲軟。英鎊淪落為從前自己的影子:自2007年起從高估18%跌落至低估4%。英國的經(jīng)歷恰與澳大利亞相反:占英國總體經(jīng)濟(jì)大部分的金融業(yè)處于金融風(fēng)暴的中心(2008年英鎊急劇貶值),而它最大的出口市場歐元區(qū)正一團(tuán)糟。

Being at the bottom of the Big Mac index need not be all bad, though. A cheap currency means exports look attractive to foreigners. Slipping down the index should, in theory, boost net exports. China manages its currency using exactly this logic: to keep the yuan cheap and demand for yuan-priced exports high.

不過處在巨無霸指數(shù)的底部也不全是壞事。便宜的貨幣意味著出口在外國人眼里更有吸引力。理論上,巨無霸指數(shù)上的下滑可以促進(jìn)凈出口。中國對人民幣的管制正是出于這一邏輯:保持人民幣價(jià)格低,就可以保證以人民幣計(jì)價(jià)的出口需求大。

Now the biggest exchange rate move economists are hoping to see is a marked fall in the value of the euro. The euro zone, in particular its sickly peripheral economies, including Spain and Greece, craves a calorific boost from the currency.

如今經(jīng)濟(jì)學(xué)家期望看到的最大匯率變動是歐元價(jià)值的顯著下滑。歐元區(qū),特別是糟糕的外圍經(jīng)濟(jì)體(包括西班牙和希臘)渴望貨幣能釋放巨大能量,來推動經(jīng)濟(jì)復(fù)蘇。