America's presidential election

美國大選

Braced for impact

準備就緒

How investors are hedging against the risk of post-election chaos

投資者如何對沖選舉后混亂的風險

Election years are not often the best times for stockmarket investors. Over the past 90 years shares included in the S&P 500, an index of America's biggest firms, have returned an average of about 8.5% a year. The twelve months leading up to each of the 22 presidential elections in that time have been leaner affairs, returning just 6%. Investors tend not to care whether the victorious candidate is Democratic or Republican, but they do like familiarity—returns are a shade higher in years when incumbents are returned to office. The democratic cycle, for all its virtues, tends to bring with it a dose of uncertainty—first about who will win and then about what that victor will do. And uncertainty tends to make financiers nervous.

對于股市投資者來說,選舉年通常不是最好的時機。在過去的90年里,包括標普500(美國最大公司的指數)在內的股票平均年回報率約為8.5%。在這22屆總統選舉之前的12個月里,每一屆的選舉都是比較輕松的,回報率只有6%。投資者并不關心獲勝的候選人是民主黨人還是共和黨人,但他們確實喜歡這種“慣例”——即當現任者重掌大權時,回報率會略微高一些。民主黨的循環雖優點多多,但往往會帶來一些不確定因素——首先是誰會贏,其次是贏了的那個人接下來會做什么。不確定性往往會讓金融家們感到緊張。

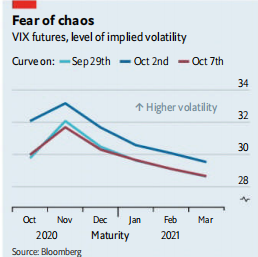

These jitters are most easily observed in VIX futures, derivatives that measure the level of volatility in stocks. Because periods of very high volatility are correlated with plunging share prices, VIX futures are often traded by investors as an insurance policy against losses in the S&P 500. Because there is usually more potential for volatility over longer time horizons, longer-dated VIX futures tend to be more expensive. They also tend to be dearer around uncertain events that are likely to prompt volatility, such as elections or even important central-bank meetings.

這種緊張在衡量股票波動性水平的衍生品VIX期貨中表現最為明顯。由于波動率非常高的時期與股價暴跌相連,所以VIX期貨通常被投資者作為一種防范標準普爾500指數下跌的保單進行交易。由于在較長時期內波動的可能性通常更大,所以較長期的VIX期貨往往更貴。而在可能引發波動的不確定事件(如選舉,甚至是重要的央行會議)發生時,它們同樣更貴。

譯文由可可原創,僅供學習交流使用,未經許可請勿轉載。