Few people would wish to trade places with Giuseppe Conte, Italy's prime minister.

沒(méi)什么人愿意和意大利總理朱塞佩·孔特交換位置。

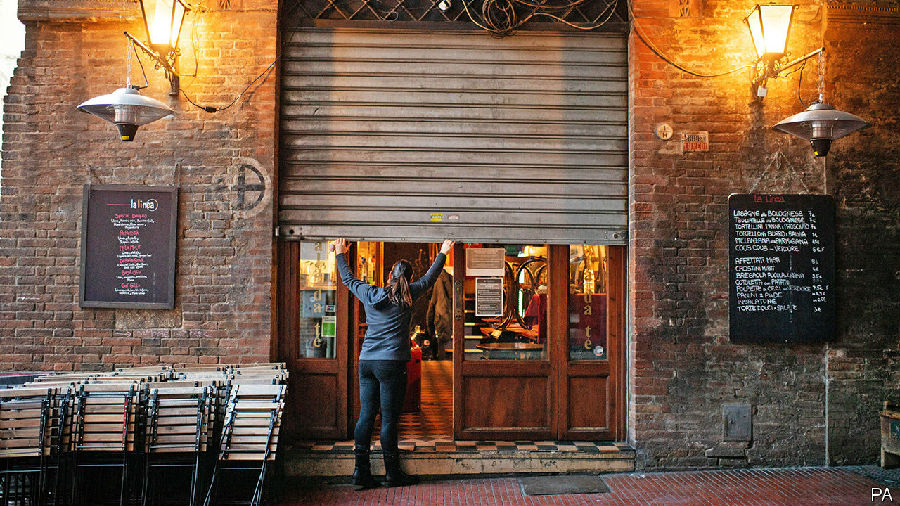

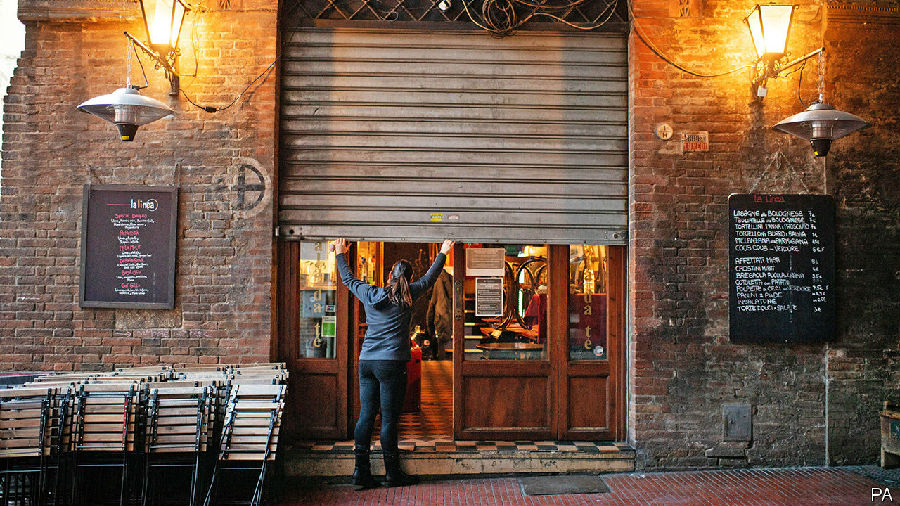

As covid-19 spread he put the entire country into lockdown for the first time since the second world war.

隨著covid-19的傳播,整個(gè)國(guó)家自二戰(zhàn)以來(lái)第一次進(jìn)入了禁閉狀態(tài)。

Now he must try to contain the economic effects. But he is finding that tackling them also depends on lenders and Europe's institutions.

現(xiàn)在他必須設(shè)法控制經(jīng)濟(jì)影響。但他發(fā)現(xiàn),解決這些問(wèn)題也依賴于放貸機(jī)構(gòu)和歐洲機(jī)構(gòu)。

The immediate prognosis is a severe contraction. Economists at JPMorgan Chase, a bank,

目前的形勢(shì)預(yù)報(bào)是嚴(yán)重收縮。摩根大通銀行的經(jīng)濟(jì)學(xué)家預(yù)測(cè)

expect GDP to fall at an annualised rate of 7.5% in the first quarter of the year.

按年率計(jì)算,今年第一季度的GDP將下降7.5%。

The hope at least is that recovery is rapid.

至少希望經(jīng)濟(jì)能夠得到迅速的復(fù)蘇。

To that end, Mr Conte said on March 11th that he would set aside 25bn euro ($28bn, or 1.4% of GDP)

為此,孔特在3月11日表示,他將撥出250億歐元(280億美元,占GDP1.4 %)

in order to cushion the epidemic's economic effects.

以緩沖流行病的經(jīng)濟(jì)影響。

The precise measures were yet to be agreed as The Economist went to press,

在刊付印之際,具體的措施尚未達(dá)成一致,

but were expected to include compensation for companies that lose revenues and workers who are laid off.

但預(yù)計(jì)將包括對(duì)失去營(yíng)業(yè)收入的公司和下崗工人的補(bǔ)償。

Ministers have also promised to help banks suspend repayments on mortgages and small-business loans for a year.

部長(zhǎng)們還承諾幫助銀行在一年內(nèi)暫停償還抵押貸款和小企業(yè)貸款。

As people fall ill and quarantines are imposed, businesses and households face abrupt disruptions to their income.

生病的人被強(qiáng)制隔離,企業(yè)和家庭的收入會(huì)突然中斷。

That means quick fixes are in high demand. Unlike public-spending measures,

這意味著對(duì)快速解決問(wèn)題方法的需求很高。與公共支出措施不同,

bank forbearance does not need legislation, and so can take immediate effect.

銀行寬限不需要立法,因此可以立即生效。

But Italy's lenders, which already have higher non-performing loan ratios than the euro-area average,

但意大利的放貸機(jī)構(gòu)(這些機(jī)構(gòu)的不良貸款率已經(jīng)高于歐元區(qū)平均水平)警告稱,

warn that they cannot cope with the loss in interest income unless the government guarantees unpaid loans,

除非政府為未償還貸款提供擔(dān)保,否則他們無(wú)法應(yīng)對(duì)利息收入的損失,

so that they do not have to hold more provisions.

這樣他們就不必持有更多準(zhǔn)備金。

In any case, leniency from lenders will help some of those most disrupted by the epidemic, but not all.

無(wú)論如何,放貸機(jī)構(gòu)的寬容會(huì)幫助一些受疫情影響最嚴(yán)重的人,但不是所有人。

Small firms, which are more likely to rely on bank finance, will benefit. But only 15% of Italian households have mortgages.

更傾向于依靠銀行融資的小企業(yè)將從中受益。但是只有15%的意大利家庭有房屋貸款。

The neediest, says Tito Boeri, a former head of the social-security administration, cannot take out loans in the first place.

社會(huì)保障署前署長(zhǎng)表示,最需要幫助的人一開(kāi)始就無(wú)法獲得貸款。

More helpful would be to extend unemployment benefit to cover the self-employed, who make up a fifth of the workforce,

更幫助的做法是將失業(yè)救濟(jì)金擴(kuò)大到占勞動(dòng)力五分之一的個(gè)體經(jīng)營(yíng)者

and temporary workers whose contracts are due to expire. For as long as the outbreak lasts,

和合同即將到期的臨時(shí)工。只要疫情持續(xù),

benefits will need to be unconditional and generous, notes Francesco Giavazzi of Bocconi University.

福利就必須是無(wú)條件且慷慨的,博科尼大學(xué)的弗朗切斯科·賈瓦齊說(shuō)到。

If they are too stingy, people will start hoarding cash, fearing that the government could withdraw its support.

如果過(guò)于吝嗇,人們就會(huì)開(kāi)始囤積現(xiàn)金,擔(dān)心政府可能會(huì)撤回對(duì)他們的支持。

譯文由可可原創(chuàng),僅供學(xué)習(xí)交流使用,未經(jīng)許可請(qǐng)勿轉(zhuǎn)載。