財經

The Big Mac Index: The All Meaty Dollar

巨無霸漢堡指數:強大的美元

Burgernomics gets to grips with a strong greenback.

漢堡經濟學發現美元走強。

IT is perhaps not surprising that the worst-performing major currency in the world this year is the Turkish lira.

或許毫無意外,今年全世界表現最差的貨幣就是土耳其里拉。

Many emerging-market currencies have taken a battering since the election in November of Donald Trump raised expectations of faster monetary tightening in America and sent the dollar soaring.

由于特朗普去年11月份當選美國總統提振了收緊美國貨幣政策和美元走強的預期,許多新興市場的貨幣遭受重創。

But the lira has many other troubles to contend with, too: terrorist bombings, an economic slowdown, alarm over plans by the president, Recep Tayyip Erdogan, to strengthen his powers, and a central bank reluctant to raise interest rates to defend the currency.

但是里拉也有許多其他的問題要應對:轟炸恐怖勢力,經濟衰退,對總統雷杰普·塔伊普·埃爾多安為了鞏固政權提出的計劃造成的恐慌,同時中央銀行不愿意提高利率而保護幣值。

It has plunged to record lows.

里拉已經降至歷史低點。

According to the Big Mac index, our patty-powered currency guide, it is now undervalued by 45.7% against the dollar.

巨無霸漢堡指數是我們基于餡餅的貨幣指導,根據這項指數,里拉如今兌美元的價值被低估45.7%。

The Big Mac index is built on the idea of purchasing-power parity, the theory that in the long run currencies will converge until the same amount of money buys the same amount of goods and services in every country.

巨無霸漢堡指數的建立基于購買力平價的思想,該理論認為在長期中,各種貨幣價值會匯集于一點,直到相同數量的貨幣能在每個國家購買相同數量的商品和服務。

A Big Mac currently costs $5.06 in America but just 10.75 lira ($2.75) in Turkey, implying that the lira is undervalued.

要制作一個巨無霸漢堡,在美國花費5.06美元,而在土耳其花費10.75里拉(2.75美元),這表明里拉價值被低估。

However, other currencies are even cheaper.

然而,其他貨幣的價值更為低廉。

In Big Mac terms, the Mexican peso is undervalued by a whacking 55.9% against the greenback.

根據巨無霸漢堡的角度看,墨西哥比索兌美元比率竟被低估55.9%之巨。

This week it also plumbed a record low as Mr Trump reiterated some of his campaign threats against Mexico.

本周,隨著特朗普重申他競選過程中對墨西哥的一些威脅言論,比索下降至歷史低點。

The peso has lost a tenth of its value against the dollar since November.

自11月以來,墨西哥比索兌美元匯價損失了十分之一。

Of big countries, only Russia offers a cheaper Big Mac, in dollar terms, even though the rouble has strengthened over the past year.

以美元來看,在各大國中,唯獨俄羅斯的巨無霸漢堡便宜的多,即便俄羅斯貨幣盧布在過去這一年中一直在增值。

The euro zone is also prey to political uncertainty.

歐元區也飽受政局風波之苦。

Elections are scheduled this year in the Netherlands, France and Germany, and possible in Italy.

今年,荷蘭、法國、德國甚至可能連意大利的大選都被提上議程。

The euro recently fell to its lowest level since 2003.

歐元近來跌至自2003年來的最低水平。

Britain’s Brexit vote has had an even bigger effect on the pound, which has fallen to $1.21, a 31-year low.

英國的脫歐公投已給英鎊帶來的影響甚至更大,英鎊已經跌至1.21美元,是31年來的最低水平。

According to the Big Mac index, the euro and the pound are undervalued against the dollar by 19.7% and 26.3%, respectively.

根據巨無霸漢堡指數,歐元和英鎊兌美元匯率各被低估19.7%和26.3%。

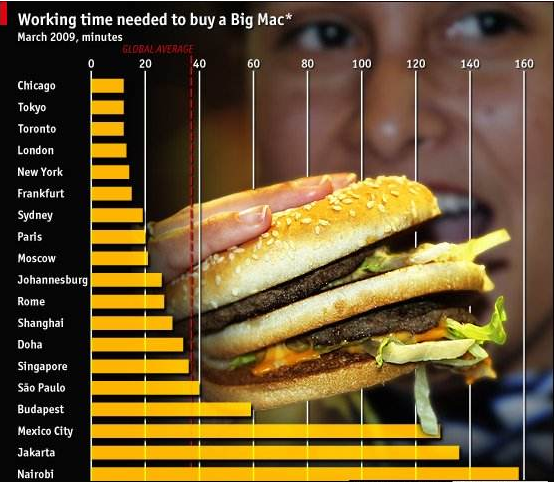

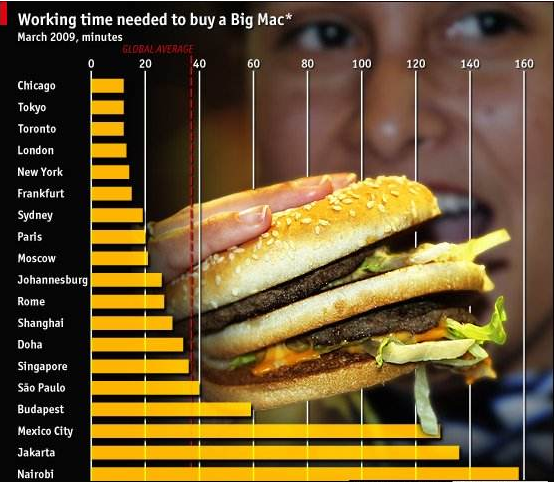

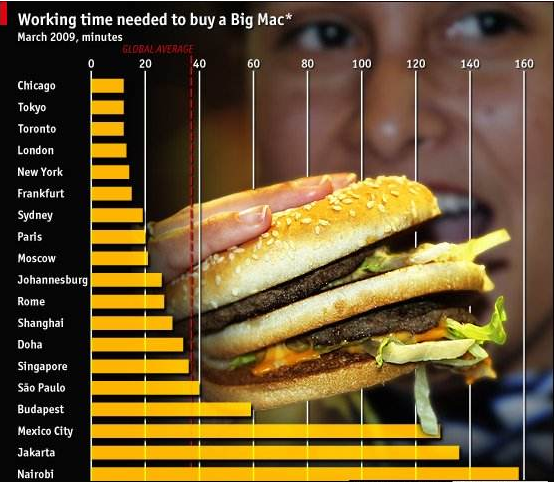

One of the drawbacks of the Big Mac index is that it takes no account of labour costs.

巨無霸漢堡指數的缺陷之一是沒有考慮勞動力成本。

It should surprise no one that a Big Mac costs less in Shanghai than it does in San Francisco, since Chinese workers earn far less than their American counterparts.

如果說一個上海的巨無霸漢堡成本低于舊金山的,應該也不會令人意外,因為中國勞工收入遠遠低于他們在美國的同行們。

So in a slightly more sophisticated version of the Big Mac index, we take account of a country’s average income.

因此,在稍微復雜一些的巨無霸漢堡指數中,我們考慮了一國的平均收入。

Historically, this adjustment has tended to raise currencies’ valuations against the dollar, so emerging-market currencies tend to look more reasonably priced.

從歷史上來看,這種調整意在提高貨幣兌美元的估價,因此新興貨幣的價格看起來會更加合理。

The Chinese yuan, for example, is 44% undervalued against the dollar according to our baseline Big Mac index, but only 7% according to the adjusted one.

以中國的人民幣為例,根據我們的基線巨無霸漢堡指數,兌美元的匯率被低估44%,但是根據調整后的指數計算,僅被低估7%。

The deluxe Big Mac index has typically made rich-world currencies look more expensive.

豪華版的巨無霸漢堡指數通常使得富裕國家貨幣顯得更高昂。

Because western Europeans have higher costs of living and lower incomes than Americans, the euro has traded at around a 25% premium against the dollar in income-adjusted burger terms since the euro’s inception.

但是,因為西歐居民相比美國居民的生活成本更高、收入更低,所以以收入調整的漢堡指數來看,自歐元啟動以來,歐元對美元的兌換比率存在大約25%的溢價。

But what once seemed to be an immutable axiom of burgernomics is true no longer.

但是過去一直被認為是真理的漢堡經濟原理不再一定正確了。

So strong is the dollar that even the adjusted Big Mac index finds the euro undervalued.

美元如此強勢以至于用調整后的巨無霸漢堡指數都得出歐元低估的結論。

The dollar is now trading at a 14-year high in trade-weighted terms.

以貿易加權的角度看,美元匯率現在正處在十四年來的高點。

Emerging-world economies may struggle to pay off dollar-denominated debts.

新興世界經濟體也許將艱難地支付美元標價的債務。

American firms may find themselves at a disadvantage against foreign competition.

美國企業或許將發覺自己面對外國競爭處于不利地位。

And American tourists will get more burgers for their buck in Europe.

同時,美國游客將可以用他們的美元在歐洲買到更多的漢堡包。