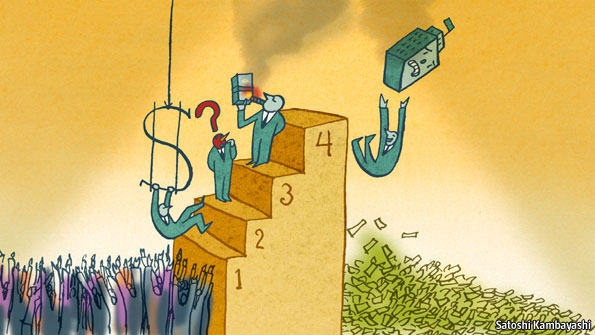

The golden rules of banking

銀行業的賺錢黃金法則

They make the rules, and get the gold

游戲規則的掌握者,金融市場的獲利人

THE crisis has taught people a lot about the banking industry and the thought processes of its leaders. These lessons can be distilled into four golden rules.

人們從這次的金融危機中學會了很多銀行業的知識,還有其領導者的思維模式。這些知識能被歸納為以下四個黃金法則:

1. The laws of supply and demand do not apply. When food producers compete to supply a supermarket, the retailer has the luxury of selecting the lowest bidder. But when it comes to investment banking, wages are very high even though the number of applicants is vastly greater than the number of posts. If the same was true of, say, hospital cleaning, wages would be slashed.

1、供給與需求法則行不通。食品市場中,當食品生產者為了給超市供應貨源而競爭時,零售商們就處于買方市場(能選擇最低出價者)。但在投資銀行市場中,哪怕應聘者遠遠多于招聘人,他們的工資還是高的離譜。如果同樣的情況在其他行業發生,比如醫院招聘清潔工,那么應聘者的工資就會被大大削減。

An investment bank, like a supermarket, demands a certain quality standard: it will not hire just anybody. But whereas it may be easy to identify a rotten banana, it is harder to be sure which trainee will be the next Nick Leeson and which the potential George Soros. That gives executives an excuse when things go wrong.

一個投行就如同一個超市,需要一定的質量標準。它不會隨隨便便聘用人。認出一個害群之馬也許很簡單,但要確認哪一個實習生會鑄成大錯成為下一個尼克 李森,又有哪一個實習生會成為下一個喬治 索羅斯無疑是很困難的。(這兩個人不認識的自己百度一下)這也給了投行高管們以犯錯誤的借口。

2. Success is down to my genius; failure is caused by someone else. When banks do well, and profits soar, the bosses are responsible for it all with their strategic cunning and inspiring leadership. Huge bonuses are therefore due.

2、成也在我,敗也在他。(不通順)銀行業搞得風生水起、利潤激增的時候,老板們的戰略決策能力和鼓舞人心的領導能力就成了大功臣。他們也因此拿了很多獎金。

But, like Macavity the mystery cat, executives were never at the scene of the crime. They did not attend the crucial meeting, read the vital memo or open the incriminating e-mail. Together with this surprising inattentiveness, executives have a remarkably faulty memory which means that conversations are rarely recalled in any detail. It is a wonder, indeed, given their technical shortcomings and early-onset Alzheimer’s, that they make it to the top of their organisations at all.

但是和隱藏的魔爪——麥卡維提一樣(詳見音樂劇《貓》),終極Boss們永遠都不會出現在犯罪現場。他們不參加重要會議,閱讀重要的備忘錄,或者打開可能會牽連自己的郵件。不僅這種不專心(對企業不上心)令人震驚,高管們的記性也出奇的爛,他們往往都記不住談話的細節。在這種技術Bug和提早老年癡呆的情況下,他們能成為高管簡直是奇跡。

But executives do tend to remember one vital fact. When scandal breaks, the blame should lie with a few rogue employees who have ignored the corporate culture. Managers cannot possibly be expected to keep track of the actions of junior staff. And that leads to the next rule.

但是高管們對一個重要的事實還是記得住的。當丑聞曝光之時,被罵的永遠是那些忽視了企業文化的“流氓”員工。經理們不可能時時刻刻盯著基層員工,這個也是下一個黃金法則的鋪墊。

3. What is lucky for an individual trader may be unlucky for the bank as a whole. There is a survivorship bias in both fund management and trading. If your career starts with some bad losses, it will quickly come to an end. So, by definition, veteran traders will have had initial success. But that could be down to luck, not skill.

3、個體獲利,集體遭殃。在投資管理和證券交易市場中都存在一個生存法則:如果你的事業以損失為開端,它很快就會終結。所以,由此可見,那些在交易戰場上經受過戰火洗禮的老兵們,最開始肯定都取得了成功。但是這個成功很可能是因為運氣,而不是實力決定的。

Successful fund managers attract more clients and thus manage more money. This will keep happening until they have a bad year, when clients will desert them. Their worst result will thus occur when they have the most money to look after. They may end up losing more client money in cash terms than they ever made.

成功的基金經理能夠吸引更多的客戶因此就能控制更多的錢。這種情況直到經濟衰退、客戶拋棄他們之前都會一直持續。最壞的結果總是在他們斂到最多錢財的時候發生,最終以虧得血本無歸告終。

Similarly, successful traders will be given more responsibility, first heading their departments and then leading the bank itself. They will gain a reputation as the kind of person who can handle risk, and they will believe their own publicity. The likes of Dick Fuld of Lehman Brothers and Jon Corzine at MF Global seemed to regard caution as a quality for wimps.

相似地,成功的證券交易人也肩負著更大的責任,有責任先富部門再富銀行。他們會因此獲得“風險應對專家”的美稱,也會因此對自己越發“自信”。例如雷曼兄弟的迪克 福爾德和全球曼氏金融的科爾辛,他們都將“入市有風險,投資須謹慎”視若耳旁風。

This is a variant of the Peter principle, which holds that managers get promoted to their level of incompetence. The trader-cum-executive will make the biggest mistake when he is in charge of the whole bank. By this stage, he will be personally rich and will remain so even if the entire bank fails, not least because:

經理們往往都會被提拔到他們無法勝任的位置,這是彼得原理的又一個變形體。如果一個證券交易人同時又作為高層管理者掌管整個銀行,那么悲劇就發生了。到了這個階段他自己會很富有,而且如果銀行垮了,他會一直富有下去,原因尤其在于:

4. Resigning can be a retirement plan. When ordinary folk resign, they are lucky to get paid to the end of the month. But when bankers leave in awkward circumstances, they make out like a lottery winner (Bob Diamond, formerly of Barclays, has done worse on this score than others). The bank may want to avoid a lawsuit, with all its unfavourable publicity. The more trouble the bank is in, the less publicity it will want and the better the negotiating position of the executive. This may not be the ideal incentive structure.

4、辭職也許就是為了養老。平民們辭職之后,月底能夠拿到養老金就很不錯了。但是當銀行家們拍拍手拋下一堆爛攤子時,他們卻贏得盆滿缽滿。(先前就職于巴克萊銀行的鮑勃 戴蒙德是個例外,這貨齪爆了。)這時候的銀行也許是想避免官司和一切對其不利的言論。銀行越深陷泥沼,越想在公眾的視線中遁走,高官們越想爭取有利的談判地位。而這個似乎并不應該作為理想的激勵機制。

Moreover, if the bank is big enough, the government will not be willing to let it fail. Take the Royal Bank of Scotland. Had it gone bankrupt, then the pension scheme might have fallen into the hands of the Pension Protection Fund (PPF), a collective-insurance plan. That would have been bad news for Fred Goodwin, the then chief executive, since individual pension payouts are capped under PPF rules. The limit at the time was £24,000 ($44,500) rather than the £703,000 he originally claimed.

而且如果銀行規模夠大,政府更不樂意讓它就這么垮了。比如蘇格蘭皇家銀行。其一旦破產,退休金計劃將會被養老金保障基金收入囊中,這是一個集體保險計劃。這對行政長官弗雷德 古德溫來說應該是個壞消息。因為個人退休金的發放由養老金保障基金掌控,而當時實際發放量是兩萬四千英鎊(約合四萬四千五百美元)而不是他起初宣布的七十萬零三千英鎊。

Bankers get such generous payoffs because it is in their contracts and airtight contracts are needed to attract the best people. But is this right? The BBC just appointed a director-general on a salary that is one-third less than that of the previous incumbent. Even so, there was no shortage of qualified applicants for the post. Back to the first rule: in banking, the laws of supply and demand do not apply.

銀行家們都能夠拿到可觀的薪水,這是勞務合同上面注明了的。要想吸引最好的人才,這種完美誘人的合同是必須的。但這是對的嗎?BBC剛剛指出一個總干事現在拿的工資比先前少了三分之一。即使如此,合格的崗位申請卻一直都不見減少。讓我們回顧一下第一個黃金法則:在銀行業,需求與供給法則從來都行不通。