A Price Worth Paying. The Economist July 6th,2013

物有所值。《經(jīng)濟(jì)學(xué)人》,2013年7月6日

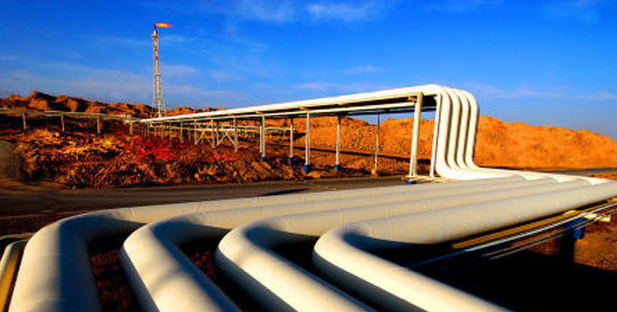

One of India's big strategic worries is energy security. It imports most of its oil. It has lots of coal but struggles to dig it up, mainly because of the state mining monopoly's ineptitude. Gas is in demand but too little is pumped: by 2016 two-fifths of India's supply is likely to come from expensive imports of liquefied natural gas (LNG). All this leaves India exposed to supply interruptions in the Middle East and elsewhere, and strains its balance of payments.

印度的重大戰(zhàn)略目標(biāo)之一是能源供給問(wèn)題。它的大部分石油依賴進(jìn)口。印度擁有大量的煤炭,但很難開(kāi)采出來(lái),主要是因?yàn)閲?guó)家礦業(yè)壟斷者的瀆職。天然氣需求量很大,但輸送出來(lái)的卻很少:到2016年,印度供氣的2/5可能來(lái)自昂貴的進(jìn)口液化天然氣(LNG)。這一切使得印度中東及其他地區(qū)會(huì)導(dǎo)致供電中斷的危險(xiǎn),并縮緊其國(guó)際收支平衡。

The country is thought to have huge potential reserves of oil and gas—perhaps the world's 15th-largest, reckons the Boston Consulting Group. But only about one-fifth of likely hydrocarbon-bearing basins are classified as "well explored". One reason is that the price domes- gas producers receive has been tightly capped at a dismal level: between $2 and $5 per million British thermal units (it varies by field and producer). Imported LNG fetches much more—around $12.

據(jù)波士頓咨詢公司測(cè)算,這個(gè)國(guó)家擁有巨大的石油和天然氣潛在資源儲(chǔ)量,或許是第十五大資源國(guó)。但是只有大約1/5的可能含烴盆地,屬于“方便開(kāi)發(fā)”的。其中一個(gè)原因就是國(guó)內(nèi)天然氣生產(chǎn)商得到的價(jià)格被嚴(yán)格的限制在一個(gè)很低的水平:介于每百萬(wàn)英國(guó)熱量單位2美元和5美元之間(由不同的場(chǎng)地和制造商區(qū)分)。進(jìn)口液化天然氣則獲取更多,大約12美元左右。

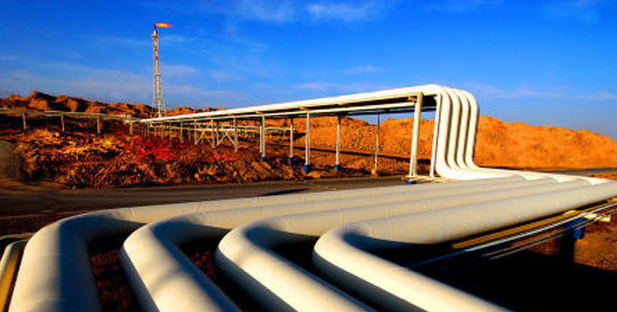

The government at last bit the bullet on June 28th, unveiling a part-liberalisation of prices. Its new formula, based on a mix of the cost of imported LNG and gas prices on world markets, will mean producers get $8.40 from next April. The change should spur investment but is controversial. Industries that use lot of gas fear a financial shock. As a result, the state will cushion the impact of higher prices on fertiliser-makers, and gas-fired power stations will be allowed to pass the increased cost onto customers. Thank you.

6月28日,政府最終決定公布一部分自由化的價(jià)格。這一基于進(jìn)口液化天然氣的混合成本和天然氣的國(guó)際市場(chǎng)價(jià)格的新準(zhǔn)則,意味著從明年4月起,制造商可拿到8.40美元的價(jià)格。這個(gè)變化將會(huì)刺激投資但這也是有爭(zhēng)議的。那些消耗大量天然氣的行業(yè)卻擔(dān)心會(huì)面臨金融沖擊。因此,國(guó)家可減輕高漲的物價(jià)對(duì)化肥制造商的影響,并且,以煤氣為燃料的發(fā)電站可將增加的成本轉(zhuǎn)嫁到消費(fèi)者身上。謝謝。