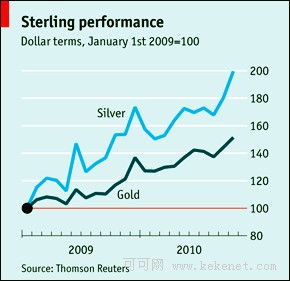

AT the first Olympic games of the modern era in 1896, winners were awarded silver medals. Since then the metal has had to get used to second-class status. But for some time now silver prices have been outpacing those of gold (see chart), its flashier neighbour on the periodic table. On September 29th silver exceeded $22 an ounce, a price not seen since 1980 when the Hunt brothers, a pair of Texan oil barons, unwisely attempted to corner the market. Then silver spiked as high as $50 an ounce before the strategy unravelled, sending the price crashing and the Hunts back to the oil business.

在1896年第一屆現代奧運會上,冠軍被授予銀質的獎牌。從此,白銀便淪為了老二的象征。不過,近來銀價上漲之速已經超過黃金(見圖),銀價一直壓著它在元素周期表上的光鮮鄰居一頭。9月29日,銀價突破22美元/盎司。上一次白銀達到如此高度還要追溯到1980年,當時德州石油大亨亨特兄弟妄圖操縱銀市,使銀價一度上漲為50美元/盎司。接著,他們的如意算盤破滅,銀價隨之崩盤,兄弟倆只能回去繼續做石油生意。

The explanation for the steady rise of silver this time round is less dramatic. But high prices have a better chance of enduring. For investors, silver and gold have much of the same allure. The combination of a weak dollar, low interest rates and economic uncertainty that has convinced some to buy gold and pushed its price up to around $1,300 an ounce has also encouraged them to put their money into other likely-looking stores of value. Silver not only offers investors diversity but it is also supported by real industrial demand.

此次銀價穩步上漲的背后就沒有這么精彩的故事了。但此次銀價高企可能會持續更長時間。對投資者而言,白銀的吸引力與黃金相同。弱勢的美元、低利率以及經濟不確定性致使人們購入黃金,將金價推上1300美元/盎司,也促使他們把錢投向與黃金相似的價值儲藏物。白銀不但可以為投資者提供多元化之選,而且其價格還受到真實產業需求的支持。

Whereas around 25-30% of gold is bought by investors, only about a tenth of global silver production goes the same way. Roughly half the world’s silver goes to industrial users (the balance is accounted for by jewellery and other silverware), although their identity has undergone a huge shift over the past decade.

大約25~30%的黃金是由投資者購買的,而白銀的這一比例只有大約10%。雖然數十年來它們的用途不盡相同,但世界上大約有一半的白銀被用于工業用途(其余則被制成首飾和銀器)。