I played a role in this "antisocial" movement.

我在這場“反社會”運動中也扮演了一定的角色。

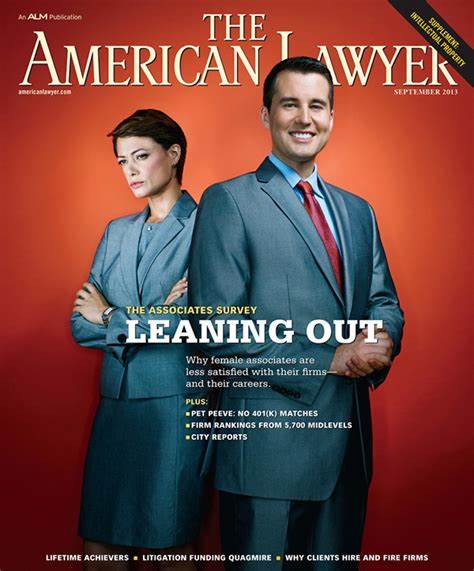

In 1979, I started a magazine called the American Lawyer,

1979年,我創辦了一本名為《美國律師》的雜志,

which focused on the business of law firms and the intriguing questions lurking behind their elegant reception areas.

重點關注的是律師事務所的業務以及隱藏在它們體面的接待區背后的一些有意思的問題。

Which ones were best managed?

比如,哪些律所管理得最好?

Which offered the most opportunity to women or minorities?

哪些律所給女性和少數群體提供的機會最多?

Which were more likely to promote associates to partnership?

哪些律所員工轉正的幾率最高?

Which had the fairest or most generous bonus systems?

哪些律所的獎金制度最公平或最慷慨?

And, yes, which provided the highest profits for partners?

是的,還有哪些律所為合伙人提供的利潤最高?

That last question resulted in the American Lawyer launching a special issue every summer, beginning in 1985,

為了探討最后一個問題,我的雜志從1985年開始每年夏天都會專門發一期特刊,

in which we deployed reporters to pierce the secrecy of these private partnerships

通過派記者去破除這些私人伙伴關系背后的秘密,

so that the magazine could rank the revenues and average profits taken home by partners at the largest firms.

我們在這期特刊上對大公司合伙人拿回家的收入和平均利潤進行了排名。

When the first survey was published, I received a call from a former classmate who practiced at a large Los Angeles firm.

初次調查結果公布后,我接到了在洛杉磯一家大公司工作的前同學打來的電話。

He was outraged because he—and his wife—had found out

他很生氣,因為他——和他的妻子——發現,

that another classmate who worked at a seemingly fungible L.A. firm made about 25% more than he did.

另一位在洛杉磯差不多同性質的公司工作的同學的收入比他高出了25%左右。

Until then, they had been perfectly happy with his six-figure income.

在那之前,他們對他六位數的收入一直都是非常滿意的。

The fallout from this report and those from similar trade publications was significant and double-edged.

這份報告以及類似貿易出版物的影響是顯著的,但也有其兩面性。

The new flow-of-market information about these businesses

關于這些企業 的新信息

made those who ran them more accountable to their partners, their employees and their clients,

使企業主對他們的合作伙伴、員工和客戶都更加負責了,

but it also transformed the practice of law by the country's most talented lawyers in ways that had significant drawbacks.

但它也以明顯存在缺陷的方式改變了這個國家最有才華的律師的法律實踐。

The emphasis was now fully on serving those clients who could pay the most.

導致他們現在將重點完全放在了服務那些能付錢最多的客戶上。

THE MERITOCRACY'S ASCENT WAS ABOUT MORE THAN PERsonal profit.

精英統治的崛起關乎的不僅僅是個人利益的問題。

As my generation of achievers graduated from elite universities and moved into the professional world,

隨著我們這一代的成功人士從精英大學畢業進入職場,

their personal successes often had serious societal consequences.

他們個人的成功往往帶來了嚴重的社會后果。

They upended corporate America and Wall Street with inventions in law and finance

他們用法律和金融領域的發明創建了一個依靠四處轉移資產的交易而非創建新資產的交易建立起來的經濟體,

that created an economy built on deals that moved assets around instead of building new ones.

他們就用這樣的發明顛覆了美國企業界和華爾街。

They created exotic, and risky, financial instruments,

他們創造了奇異且高風險的金融工具,

including derivatives and credit default swaps, that produced sugar highs of immediate profits

如金融衍生品和信用違約掉期(cds),給消費者許下了立竿見影的高額利潤的美夢,

but separated those taking the risk from those who would bear the consequences.

但又把承擔風險的人和承擔后果的人分開了。

They organized hedge funds that turned owning stock into a minute-by-minute bet rather than a long-term investment.

他們組建對沖基金,把持有股票變成按秒計算的押注而不是長期的投資。

They invented proxy fights, leveraged buyouts and stock buybacks that gave lawyers and bankers a bonanza of new fees

他們發明代理權之爭、杠桿收購和股票回購,給律師和銀行家帶來了巨額的費用,

and maximized short-term profits for increasingly unsentimental shareholders,

將越來越冷靜的股東的短期利潤最大化,

but deadened incentives for the long-term growth of the rest of the economy.

卻也抑制了對經濟體內其他主體的長期增長的激勵。

譯文由可可原創,僅供學習交流使用,未經許可請勿轉載。