Economics brief: six big ideas.

經濟概要:六大經濟思想。

Game theory: Prison breakthrough

博弈論:越獄

The fifth of our series on seminal economic ideas looks at the Nash equilibrium.

六大經濟思想之五——納什均衡。

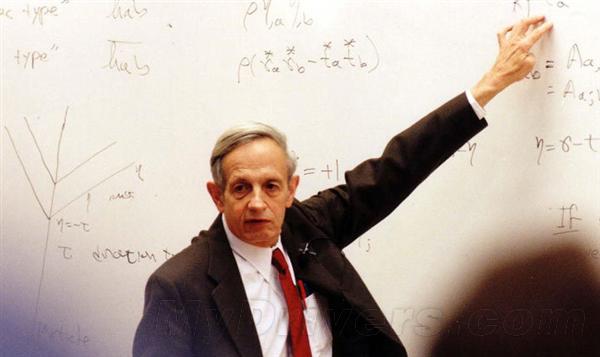

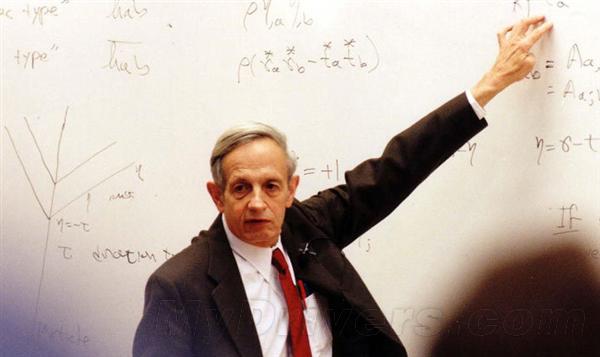

JOHN NASH arrived at Princeton University in 1948 to start his PhD with a one-sentence recommendation: “He is a mathematical genius”.

1948年,約翰·納什帶著一句話的推薦信——他是一個數學天才——來到普林斯頓大學開始讀博。

He did not disappoint.

他沒有令人失望。

Aged 19 and with just one undergraduate economics course to his name, in his first 14 months as a graduate he produced the work that would end up, in 1994, winning him a Nobel prize in economics for his contribution to game theory.

年僅19歲且名下只有一個經濟學課程的他,在讀博的頭14月中就交出了最終會在1994年因為對博弈論的貢獻而為他贏得了諾貝爾經濟學獎的研究。

On November 16th 1949, Nash sent a note barely longer than a page to the Proceedings of the National Academy of Sciences, in which he laid out the concept that has since become known as the “Nash equilibrium”.

1949年11月16日,納什給《美國國家科學院院刊》寄去了一份剛夠一頁紙長的筆記,在這份筆記中,他提出了自此聞名遐邇的“納什均衡”概念。

This concept describes a stable outcome that results from people or institutions making rational choices based on what they think others will do.

這個概念描述了一種源自個人或機構基于自身之于別人將做什么的認識而做出理性選擇的穩(wěn)定結果。

In a Nash equilibrium, no one is able to improve their own situation by changing strategy: each person is doing as well as they possibly can, even if that does not mean the optimal outcome for society.

在納什均衡中,無人能夠通過改變策略而改善自身境況:每一個人都在盡其所能地做事,雖然這不意味著社會的最佳結果。

With a flourish of elegant mathematics, Nash showed that every “game” with a finite number of players, each with a finite number of options to choose from, would have at least one such equilibrium.

借助于優(yōu)雅數學的表述,納什告訴人們:每一場參與者數量有限每一位參與者可供選擇的選項數量也是有限的“博弈”都至少會有一個這樣的均衡。

His insights expanded the scope of economics.

他的高見擴展了經濟學的范圍。

In perfectly competitive markets, where there are no barriers to entry and everyone's products are identical, no individual buyer or seller can influence the market: none need pay close attention to what the others are up to.

在完全競爭市場中,沒有進入門檻且所有人的產品都完全相同,沒有單獨的買方或賣方能夠影響市場:誰也不需要密切關注別人正在忙什么。

But most markets are not like this: the decisions of rivals and customers matter.

但是,大多數市場不是如此:對手和客戶的決定至關重要。

From auctions to labour markets, the Nash equilibrium gave the dismal science a way to make real-world predictions based on information about each person's incentives.

從拍賣到勞動力市場,納什均衡給這門沉悶科學提供了一種基于每一個人的動機信息做出現實生活預測的方法。

One example in particular has come to symbolise the equilibrium: the prisoner's dilemma.

一個例子尤其代表了這種均衡:囚徒困境。

Nash used algebra and numbers to set out this situation in an expanded paper published in 1951, but the version familiar to economics students is altogether more gripping.

納什曾在1951年發(fā)表的一篇延伸論文中運用代數和數字論述了這種情景。但是,經濟學學生熟悉的版本更為吸引人。

(Nash's thesis adviser, Albert Tucker, came up with it for a talk he gave to a group of psychologists. )

(納什的論文導師阿爾伯特·塔克爾曾在對一群心理學家的談話中提到過它。)

It involves two mobsters sweating in separate prison cells, each contemplating the same deal offered by the district attorney.

它說的是兩名正在單獨牢房中如坐針氈的犯罪分子,每個人都在考慮由地區(qū)檢察官提出的同樣交易。

If they both confess to a bloody murder, they each face ten years in jail.

如果他們雙雙承認身犯命案,每人都面臨十年牢獄。

If one stays quiet while the other snitches, then the snitch will get a reward, while the other will face a lifetime in jail.

如果一個人堅持不說,另一個人告密揭發(fā),告密之人將得到獎賞,而另外那個人將面臨終身監(jiān)禁;

And if both hold their tongue, then they each face a minor charge, and only a year in the clink.

如果兩人都閉口不言,那么,每個人都面臨較小的指控,而且只有一年刑期。

There is only one Nash-equilibrium solution to the prisoner's dilemma: both confess.

對這種囚徒困境,只存在一種納什均衡的解決方案:兩人雙雙坦白。

Each is a best response to the other's strategy; since the other might have spilled the beans, snitching avoids a lifetime in jail.

每一方的坦白都是對對方策略的最佳應對;因為另一個人可能說漏嘴,告密揭發(fā)避免了終身監(jiān)禁。

The tragedy is that if only they could work out some way of co-ordinating, they could both make themselves better off.

悲劇就在于,如果他們能夠找到合作之法,兩人都可能讓自己的處境好起來。

The example illustrates that crowds can be foolish as well as wise; what is best for the individual can be disastrous for the group.

這個例子表明,除了明智之外,眾人也可能是愚蠢的;個體的最佳可能是集體的災難。

This tragic outcome is all too common in the real world.

在現實世界中,這種悲劇性結果太常見了。

Left freely to plunder the sea, individuals will fish more than is best for the group, depleting fish stocks.

耗盡漁業(yè)資源的涸澤而漁,利在個人,弊在集體;

Employees competing to impress their boss by staying longest in the office will encourage workforce exhaustion.

通過最長時間地待在辦公室中的辦法而博得老板印象的雇員將鼓勵員工耗盡精力;

Banks have an incentive to lend more rather than sit things out when house prices shoot up.

房價大漲的時候,銀行有動力放出更多貸款,而不是袖手旁觀。

The Nash equilibrium helped economists to understand how self-improving individuals could lead to self-harming crowds.

納什均衡曾給經濟學家理解自我完善的個人如何能夠成為自暴傷害的大眾提供了幫助。

Better still, it helped them to tackle the problem: they just had to make sure that every individual faced the best incentives possible.

更重要的是,它還曾幫助他們去解決這個問題:他們只需確認,每一個單獨的個人都面對最佳激勵可能。

If things still went wrong—parents failing to vaccinate their children against measles, say—then it must be because people were not acting in their own self-interest.

如果仍然出現問題——例如父母沒能讓孩子接種麻疹疫苗——那么,這必然是因為當時人們沒有以符合自身利益的方式行事。

In such cases, the public-policy challenge would be one of information.

在這種情況下,公共政策的挑戰(zhàn)會是信息的挑戰(zhàn)。

Nash's idea had antecedents.

納什的思想有先例。

In 1838 August Cournot, a French economist, theorised that in a market with only two competing companies, each would see the disadvantages of pursuing market share by boosting output, in the form of lower prices and thinner profit margins.

1838年,法國經濟學家奧古斯丁·古諾提出了下面這種理論:在只有兩家競爭公司的市場中,每一家公司都會看到通過提高產出,以更低的價格和更微薄的利潤形式,來追求市場份額的弊端。

Unwittingly, Cournot had stumbled across an example of a Nash equilibrium.

有意無意之間,古諾發(fā)現了一個納什均衡的例子。

It made sense for each firm to set production levels based on the strategy of its competitor; consumers, however, would end up with less stuff and higher prices than if full-blooded competition had prevailed.

對于每一家來說,根據競爭對手的策略決定生產水平是有意義的;然而,在激烈競爭占上風的前提下,消費者最終面對越來越少的商品和越來越高的價格。

Another pioneer was John von Neumann, a Hungarian mathematician.

另一位先驅是匈牙利數學家約翰·馮·諾依曼。

In 1928, the year Nash was born, von Neumann outlined a first formal theory of games, showing that in two-person, zero-sum games, there would always be an equilibrium.

1928年,即納什出生的那一年,馮·諾依曼概述了最早的正式博弈論,表明,在兩人的零和博弈中,向來存在一種均衡。

When Nash shared his finding with von Neumann, by then an intellectual demigod, the latter dismissed the result as “trivial”, seeing it as little more than an extension of his own, earlier proof.

當納什把自己的發(fā)現與當時已是知識分子偶像的馮·諾依曼分享時,后者斥之為 “無關緊要” 的結果,認為它不過是他自己早期證明的一種延伸而已。

In fact, von Neumann's focus on two-person, zero-sum games left only a very narrow set of applications for his theory.

實際上,馮·諾依曼之于兩人零和博弈的強調只給他的理論留下了非常狹窄的應用。

Most of these settings were military in nature.

這些前提大都是軍事性的。

One such was the idea of mutually assured destruction, in which equilibrium is reached by arming adversaries with nuclear weapons (some have suggested that the film character of Dr Strangelove was based on von Neumann) .

其中之一就是其中的均衡是由于裝備了核武器的的對手才達到的相互確保毀滅的思想。(有人認為,奇愛博士這位電影人物就是以馮·諾依曼為原型的) .

None of this was particularly useful for thinking about situations—including most types of market—in which one party's victory does not automatically imply the other's defeat.

在這些前提中,沒有一種對考慮一方的勝利并非自動地意味著另一方的失敗的情形——包括大多數類型的市場——特別有用。

Even so, the economics profession initially shared von Neumann's assessment, and largely overlooked Nash's discovery.

即便如此,經濟學界一開始還是認可了馮·諾依曼的評估,并在很大程度上忽視了納什的發(fā)現。

He threw himself into other mathematical pursuits, but his huge promise was undermined when in 1959 he started suffering from delusions and paranoia.

納什一頭扎進了自己在數學方面的其他追求,但是,當他在1959年開始遭受幻覺和強迫癥折磨時他的遠大前程遭遇了滅頂之災。

His wife had him hospitalised; upon his release, he became a familiar figure around the Princeton campus, talking to himself and scribbling on blackboards.

他的妻子把他送進了醫(yī)院;出院后,他成了普林斯頓校園中的一個熟悉的身影,不是自言自語,就是在黑板上涂涂寫寫。