The asset-quality review

資產(chǎn)質(zhì)量審查

Gentlemen, start your audits

先生們,開始審計吧

Close scrutiny of Europe’s banks may turn up unexpected shortfalls

對歐洲銀行的密切關(guān)注可能會變成意外的資金短缺

Oct 5th 2013 |From the print edition

THE ink on the agreements that will hand supervision of the euro area’s biggest banks to the European Central Bank (ECB) is barely dry. Yet the ECB is already enmeshed in squabbles with national banking supervisors over the extent of its powers and the rigour with which it will undertake its first big task, a warts-and-all review of the balance-sheets of the banks it will take charge of in a year’s time.

歐元區(qū)剛剛敲定將歐元區(qū)的監(jiān)管權(quán)交給歐洲最大的銀行歐洲中央銀行的協(xié)議。然而,歐洲央行已經(jīng)卷入與國家銀行監(jiān)管機構(gòu)的爭吵之中,爭吵圍繞其權(quán)利范圍以及其承擔(dān)第一大任務(wù)之嚴(yán)格。其將會在一年時間里審查所有銀行的資產(chǎn)負(fù)債表。

Details over how the ECB will conduct this asset-quality review (AQR) will probably be released in the second half of October, but the outlines are already beginning to emerge. The main aim of the review is to ensure that the ECB is not embarrassed by the revelation of holes in the balance-sheets of its new charges. Fresh in its mind is the example of the European Banking Authority (EBA), a young European regulator that lost much of its credibility after the collapse of banks that had passed its stress tests only months earlier.

雖然關(guān)于歐洲央行如何進(jìn)行資產(chǎn)質(zhì)量審查的詳細(xì)細(xì)節(jié)可能會在十月下半月公布,但是大體狀況已經(jīng)開始初現(xiàn)端倪了。這次審查的主要目的是確保歐洲央行新接管的這些銀行的資產(chǎn)負(fù)債表的缺口不會讓其尷尬。歐洲銀行管理局的例子還讓人記憶猶新,這個年輕的歐洲監(jiān)管機構(gòu)由于通過其壓力測試的銀行紛紛崩潰而在幾個月前失去了公信力。

To avoid that danger the ECB is emphasising that the AQR is not a stress test, which would simulate the effect of various economic scenarios on banks’ balance-sheets. Instead it is doing a preliminary examination to ensure that it understands what is on banks’ books in the first place. National regulators fret that they will be embarrassed by what it finds. This has prompted some to push back hard to limit the scope of the ECB’s inquiries.

為了避免上述危險,歐洲央行強調(diào)資產(chǎn)質(zhì)量審查不是一次壓力測試,模擬各種經(jīng)濟(jì)情況對資產(chǎn)負(fù)債表的影響。取而代之的是,它會做一次初步檢查確保其會在第一時間了解銀行的狀況。國家監(jiān)管機構(gòu)擔(dān)心他們會對央行的發(fā)現(xiàn)感到尷尬。這已經(jīng)促使一些人強硬地限制了歐洲央行查詢范圍。

Surprisingly, this resistance is not coming from countries on Europe’s periphery such as Spain (see article), which have much to gain from the imprimatur of ECB supervision. Rather it is coming from core countries such as France and, to a lesser extent, Germany, where seemingly well-capitalised banks may come out of the asset review looking threadbare.

令人驚訝的是,這種阻力不是來自諸如西班牙的歐洲外圍國家,西班牙很需要歐洲央行監(jiān)管的首肯。相反,這種阻力是來自法國等核心國家,還有德國的反對,只不過程度稍輕。這些國家看似資金充裕的銀行可能會出現(xiàn)難看的資產(chǎn)審查結(jié)果。

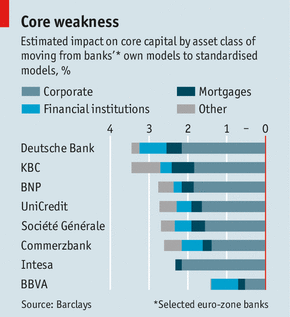

One issue is the “risk weighting” of assets, a process by which banks adjust the size of their capital buffer to account for the riskiness of their lending. Studies by both the Basel Committee, a club of central bankers and supervisors, and the EBA have found wide and unjustifiable variations in the way banks risk-weight their assets, even when asked to do so for identical hypothetical portfolios. The consequences of such variations can be significant. If the euro area’s biggest banks were forced to abandon their internal risk-weighting models and instead apply cruder standardised models, many would see their core-capital ratios decline by several percentage points (see chart). The ECB is likely to push for greater consistency in risk weighting, which could force banks in France, Germany and elsewhere to raise capital.

其中一個問題是資產(chǎn)的風(fēng)險加權(quán),通過風(fēng)險加權(quán),銀行可以調(diào)整資本緩沖規(guī)模沖抵其貸款風(fēng)險。央行行長和監(jiān)事俱樂部巴塞爾委員會和歐洲銀行管理局的研究發(fā)現(xiàn)銀行中廣泛存在各種不合理的資產(chǎn)風(fēng)險權(quán)重方式,甚至是為了相同的假設(shè)投資組合。這些方式的后果是嚴(yán)重的。如果歐元區(qū)最大的銀行被迫放棄他們內(nèi)部的風(fēng)險權(quán)重模型,許多銀行會發(fā)現(xiàn)它們的核心資本比率下降幾個百分點(見表)。歐洲央行很可能會推行更大規(guī)模統(tǒng)一的風(fēng)險權(quán)重,會迫使法國德國以及歐洲其他地方的銀行籌集資金。

Informed observers also expect the ECB to find evidence of “regulatory forbearance” in these markets, whereby supervisors have allowed banks to fudge the level of non-performing loans on their books, restructuring loans and easing repayment terms instead of taking write-downs. Adjusting for this could also open up capital holes. A process devised by Germany and France to shore up confidence in weak banks on Europe’s periphery may end up hitting a quite unexpected target.

消息靈通的觀察家同時預(yù)計歐洲央行將找到在這些市場“監(jiān)管縱容”的證據(jù),在這些市場,監(jiān)管機構(gòu)允許銀行在資產(chǎn)負(fù)債表上對不良貸款程度作假,重組貸款,延長還款期,而不是采取減記。對此作出調(diào)整可能會導(dǎo)致資金缺口。由法國德國設(shè)計的提振歐洲外圍國家銀行信心的方法可能會以擊中一個意想不到的目標(biāo)而告終。