Finance and Economics;Japanese banks in Asia; Lending a hand;

Japan's biggest banks help pick up the slack from retreating Europeans;

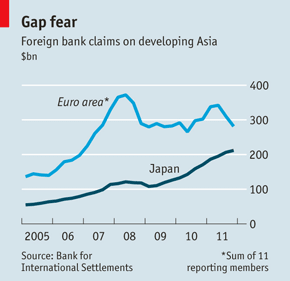

There are two, potentially overlapping, ways in which Asia's export-driven economies could suffer from the euro crisis. One is from the slowdown in trade to Europe. The other is the drying up of finance, from trade credit to syndicated loans, extended by euro-zone banks. On neither score is Asia as vulnerable as it was after the collapse of Lehman Brothers in 2008, argued Iwan Azis of the Asian Development Bank, at The Economist's Bellwether conference in Tokyo on May 16th. One of the reasons is that Japan's mega-banks have lumbered off their home territory to pick up some of the slack left by the departing Europeans (see chart).

This is good news not just for Asia's exporters. It also shows a rare stroke of boldness by Japan's big three, Mitsubishi UFJ Group (MUFG), Sumitomo Mitsui, and Mizuho. After pulling back from lending to Asia following the 1998 financial crisis, and then suffering more than a decade of deleveraging by their deflation-sapped customers at home, they can almost smell the predicament of their European peers. Ken Takamiya of Nomura Securities says that in Australia, for instance, the mega-banks' lending has recently overtaken that of BNP Paribas and Société Générale, two retreating French banks. It is the same story elsewhere in Asia, he thinks.

Some of the banks trumpeted their ability to buy discarded European assets abroad, as well as making fresh loans in Asia, when they released reports on May 15th showing a sharp increase in profits last fiscal year. These profits largely reflected the sale of big helpings of Japanese government bonds, but foreign activities help. Mr Takamiya says returns on overseas assets at MUFG's biggest bank generate about 2.5%, versus less than 1.5% at home.

Secondly, their ambitions to be more innovative are modest for now. Rival bankers snort that Japan's lending is “pure balance-sheet”, meaning they make large syndicated and project-finance loans that are often long-term and low-margin. They lack the more sophisticated and lucrative cash-management, foreign-exchange and other services of Western peers.