The D-word

“蕭條”的出現頻率

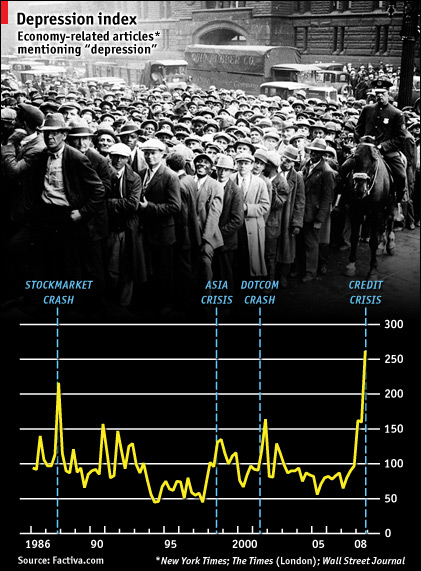

Signs of a pending depression? The Economist’s D-word index

《經濟學人》提出的蕭條指數預示著經濟蕭條即將來臨?

MANY comparisons may be made between the devastation being wrought on America’s financial system today and the Wall Street crash of 1929. One similarity that the world is desperate to avoid is a repeat of the depression of the 1930s. Hopes are pinned on the American bail-out plan that the House of Representatives is set to reconsider on Friday October 3rd. If the fear of depression is anything to go by, the future looks bleak. A survey of newspaper articles over the past two decades shows a sharp spike in mentions of the dreaded D-word, as commentators have started to think the worst. The prognostications may possibly turn out to be true, or perhaps the only thing we have to fear are the fears of journalists themselves.

人們或許將如今美國金融系統遭遇的重創同1929年的華爾街大崩盤做了許多比較。它們有一個相似之處,那就是1930年代經濟危機的重復,而這也正是世界所極力避免的。希望都寄托在美國的 救市計劃上,眾議院將于10月3日周五重新審核該計劃。如果用對經濟蕭條的恐懼作為判斷標準的話,前景著實堪憂。對過去20年來新聞報道文章的分析表明, 當評論員們開始對經濟狀況做最壞打算時,可怕的“蕭條”字眼出現頻率變高。而目前的蕭條指數已經是過去20年來的最高值了。這個預兆可能真的會應驗,但或 許記者們自身的恐懼情緒才是唯一應該讓我們感到害怕的東西。