Don’t bank on it

不要指望它

Are your life savings protected?

你的存款得到保護沒?

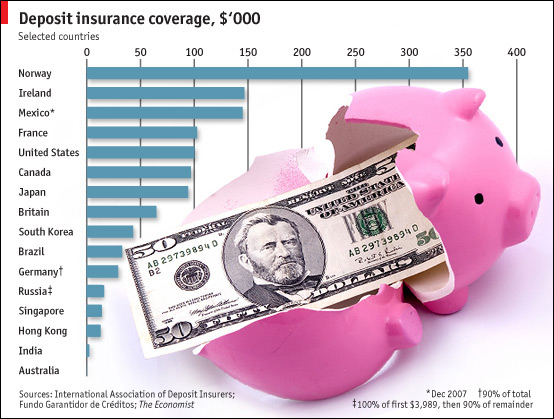

AS BANKS tumble like skittles, customers across the world are eyeing their cash nervously. Savings are protected in around 100 countries, with varying degrees of generosity. Those spooked by a run on a bank in Hong Kong this month may have been particularly nervous because only HK$100,000 ($12,860) of their cash is protected, including interest. Ireland has recently extended its limit from 20,000 ($29,337) to 100,000, to reassure savers. In America the first $100,000 is guaranteed for each depositor at each bank, while Britain’s savers are limited to £35,000 ($64,650) in one institution, although an increase is expected soon. It is not only a matter of how much is protected, of course, but also of how quickly and easily the savers would get it back.

如今銀行紛紛倒閉,儲戶們都正緊張的盯著自己的存款。全球約有100個國家實行了存款保險制度,但存款保險的限額卻不甚相同。本月香港一家銀行遭遇擠兌風 潮,該銀行的儲戶們或許會格外緊張,因為該銀行的存款保險限額是10萬港幣,這還包括利息在內(nèi)。為安撫儲戶,愛爾蘭最近將其存款保險限額由2萬歐元提至 10萬歐元。在美國,每個儲戶在每家銀行的存款中,只有第一筆10萬美元存款得到保障。而在英國,這個數(shù)字則為3.5萬英鎊,盡管該限額有望于近期上調(diào)。現(xiàn)在的問題當然不僅是有多少錢得到了保障,更在于儲戶如何才能快速容易的取回自己的存款。