Emerging Asia’s biggest noodle producers are competing to spice up the humble packet of instant noodles in an attempt to boost revenues as sales of low-end, everyday noodles stagnate.

隨著低端方便面銷售陷入停滯,亞洲新興經濟體的各大方便面生產商正競相讓不起眼的方便面走高檔化路線,以求提振營收。

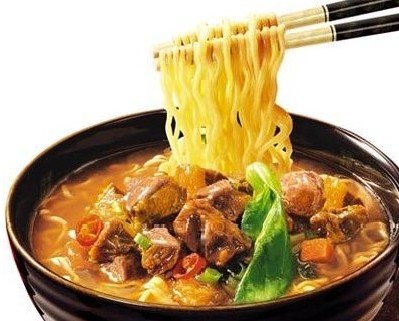

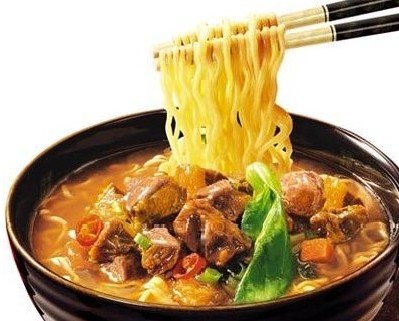

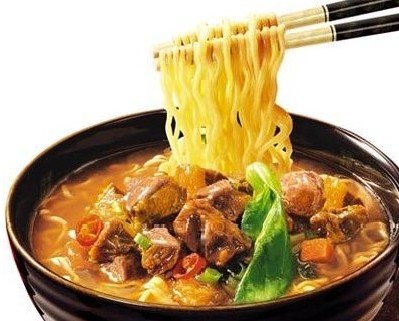

High in energy, low in nutrition and selling for as little as $0.10, easy-to-cook instant noodles have become a staple food for more than 1bn people across Asia and a cash cow for companies such as Tingyi, Uni-President and Indofood, which dominate the $33bn market.

方便面熱量高,營養低,烹制容易,售價可低至0.1美元,已成為亞洲逾10億人口的主食,也是康師傅(Tingyi)、統一企業(Uni-President)、印多福(Indofood)等公司的搖錢樹,這三家主宰著這個330億美元的市場。

In pushing their customers to trade up to more expensive and profitable types of noodles, these companies are following in the footsteps of global consumer goods companies such as Unilever and Nestlé, which have deployed this “premiumisation” strategy on everything from shampoo to ice cream.

這些方便面公司正推動消費者購買價格更貴、利潤更高的方便面,從而踏上了聯合利華(Unilever)、雀巢(Nestlé)等全球消費品企業的后塵,這兩家公司已在從洗發精到冰淇淋的種種產品上實施了這種“高端化”(premiumisation)策略。

Last year, for example, Unilever bought T2, an Australian premium tea business to complement its mass market Lipton teas. It has been selling underperforming brands that have mainly been in relatively unhealthy food categories, such as Skippy peanut butter, Wish-Bone dressings and its Peperami salami snack.

比如,聯合利華去年收購了澳大利亞高端茶葉零售商T2,以補充旗下大眾市場茶葉品牌立頓(Lipton)。該公司出售了幾個效益不佳的品牌,基本上都是相對不健康的食品,如四季寶(Skippy)花生醬,Wish-Bone沙拉醬和Peperami零食香腸。

Having launched joint ventures with the likes of Japan’s Asahi and local Pepsi bottlers, Asia’s noodle makers are branching out into more lucrative soft drinks and snacks, capitalising on the unrivalled distribution networks they have built in China and Indonesia, the world's first- and fourth-most populous countries.

亞洲方便面生產商已與日本的朝日(Asahi)及當地百事(Pepsi)瓶裝公司成立合資企業,涉足利潤更高的軟飲料和零食領域,并充分利用他們在中國和印尼建立起來的無可比擬的分銷網。中國和印尼分別為世界第一和第四人口大國。

Over the past two decades, the instant noodle revolution in Asia helped make the Taiwanese founders of Tingyi and Uni-President, and the family behind Indonesia’s Indofood, wealthy tycoons. The four Wei brothers who built Tingyi are the third-richest family in Taiwan, according to Forbes.

過去20年期間,亞洲的方便面革命幫助康師傅和統一的臺灣創始人,以及印尼印多福背后的家族成為富商巨賈。根據《福布斯》(Forbes)的資料,創立康師傅的魏氏四兄弟是臺灣第三富家族。

Indonesia’s Salim family, which built Indofood after obtaining a monopoly licence to mill flour under the Suharto dictatorship, controls large parts of the economy from car distribution to the local KFC franchise.

印尼三林家族(Salim)控制著從汽車銷售到當地肯德基(KFC)特許經營權的相當大一部分經濟。該家族在蘇哈托(Suharto)獨裁時期取得壟斷的磨面許可,由此打造起印多福公司。

But with the markets for cheap noodles saturated in China and Indonesia, the two biggest consumers of instant noodles, these companies are racing to produce higher-value products, from more exotic flavours to more convenient cup noodles that can be eaten straight out of their packaging.

但隨著中國和印尼這兩個最大的方便面消費國的平價方便面市場逐漸飽和,這些公司開始競相生產價值更高的產品,從比較異國風味的產品,到可以直接在包裝里吃的更方便的杯面。

In addition, noodle makers face the rising costs of wheat and other raw materials, and a shift by Asia’s emerging middle class away from snack foods toward healthier options, an established trend in the US and Europe.

此外,方便面生產商還面臨著小麥及其他原材料成本上漲,以及亞洲新興中產階層舍棄快餐食品,轉向更健康飲食的挑戰,后者在美國和歐洲早已形成趨勢。

“Indonesians eat more noodles per capita than any other country apart from South Korea, so I don't think they can eat that many more noodles,” says Erwan Teguh, head of research at CIMB in Jakarta. “As volume growth slows, it’s all about pushing value growth and getting people to trade up.”

“印尼人的人均方便面食用量僅次于韓國,所以我不認為他們還能大幅增加自己的面條食用量。”雅加達聯昌國際(CIMB)的研究部主任Erwan Teguh說,“隨著銷量增長放緩,能做的就只有推動價值增長,推動人們購買高檔產品。”

Annual per capita consumption of noodles in Indonesia rose by an average of 5.2 per cent from 2001, to reach 66 packets a year in 2007. Since then it has declined 1.5 per cent a year to 61 packets last year, according to Malaysia’s Maybank.

根據馬來西亞馬來亞銀行(Maybank)的數據,印尼人均方便面消費量從2001年起以年均5.2%的增速上漲,至2007年達到人均66包。2007年以后又以每年1.5%的速度下降,到去年降至人均61包。

About 43 per cent of Indonesia’s 250m people live on less than $2 a day, and many eat instant noodles several times daily.

印尼2.5億人口中,大約43%的人每日生活費低于2美元,許多人一天吃好幾頓方便面。

Similarly, sales growth in China slowed from 12 per cent in 2012 to 3 per cent in 2013, according to Bernstein. But in China, where consumption per capita is roughly half that of Indonesia, the culprit is primarily demographics.

根據伯恩斯坦(Bernstein)的數據,中國的方便面銷售增長同樣在下降,從2012年的12%降至2013年的3%。但在人均消費量大致僅為印尼一半的中國,增長放緩的主因在于人口結構。

Analysts at Citi say the rates of growth in migrant worker and student populations in China have been shrinking in recent years – bad news for noodle makers as these groups are large consumers of such convenience foods.

花旗(Citi)分析師表示,中國的外來務工人員和學生人數增長率近年有所下降,這對方便面生產商來說是壞消息,因為這兩大群體是方便食品的消費主力。

As market conditions have shifted, companies have been forced to compete on price and product innovation, squeezing profit margins.

隨著市場環境發生變化,各公司被迫在價格和產品創新方面展開競爭,利潤率受到擠壓。

Tingyi, which has more than 50 per cent market share by value in China, saw its gross margins for noodles slip from 30 to 29 per cent in 2013. Uni-President, a distant second with 17 per cent of the market, has had to cut prices more deeply to stay competitive and its gross margin fell from 33 per cent to 2 per cent in the same period.

在中國占據逾50%市場份額的康師傅,2013年毛利潤率從30%下滑至29%。市場占有率為17%、遙居第二的統一不得不以更大幅度降價以保持競爭力,同期毛利潤率從33%跌至2%。

Charles Yan, head of China consumer research at Standard Chartered in Hong Kong, says that while these companies are unlikely to continue increasing sales volumes, they have ample room to sell more expensive noodles as the Chinese economy continues to grow rapidly.

香港渣打銀行(Standard Chartered)大中華區消費品研究主管嚴志雄(Charles Yan)表示,雖然這些公司不太可能保持銷量持續增長,但隨著中國經濟繼續快速增長,他們有銷售較高價方便面的大量空間。

He points out that Chinese consumers in wealthier Hong Kong and Taiwan fork out roughly double the amount spent on noodles each year by their counterparts in China and Indonesia.

他指出,在更為富裕的香港和臺灣,消費者每年在方便面上的支出大致是中國和印尼消費者的兩倍。

Indomie, Indofood’s best-known brand, recently launched a Taste of Asia range that includes Thai Tom Yam and Korean Bulgogi flavours and sells for about Rp4,000 ($0.35) per packet, more than double the price of its typical Indonesian options.

印多福旗下知名品牌營多面(Indomie)最近推出了“亞洲味道”(Taste of Asia)系列,包括“泰國冬蔭”(Tom Yam,也稱:泰式酸辣湯)及“韓國烤肉”(Bulgogi),每包售價約為4000盧比(0.35美元),是其印尼市場典型產品售價的兩倍多。

Producers in Indonesia and China are pushing cup noodles, which sell for three to four times as much as a regular packet. Analysts say sales of cup noodles are growing at double-digit rates because of demand from time-poor, city dwellers.

印度尼西亞和中國的生產商正推動杯面的銷售,其售價為普通袋裝面的三到四倍。分析師表示,得益于時間寶貴的城市居民的需求,杯面銷量正以兩位數的速率增長。

“It’s all about convenience,” says Mr Teguh. “Rather than putting the noodles in a pan and cooking them, they just put hot water in a cup.”

“關鍵是方便。”Teguh說,“杯面不用將面條放到鍋里煮,只要往杯子里加熱水就行了。”

Typically, noodles are bought in small single-serving plastic packets of 80g and boiled in a pan for about two minutes.

市場上出售的袋裝面一般裝在每份一包(80克)的塑料包裝袋里,需在鍋中煮2分鐘左右。

Sales of noodles with reduced salt and fat content are picking up sharply, albeit from a low base, as an increasing number of middle class consumers adopt healthier lifestyles.

隨著越來越多的中產階層消費者傾向更健康的生活方式,減鹽、減脂的方便面銷量正急速提升,盡管基數較低。

Despite the challenges they face, Asia's biggest noodle producers are well placed to tap changing consumer tastes, having built vast distribution networks that stretch to remote villages in large countries with poor infrastructure, and are expanding aggressively into more lucrative segments.

雖然面對著種種挑戰,但亞洲各大方便面生產商在利用消費者的口味變化方面處于有利地位,因為他們已經建立龐大的分銷網絡,即使在那些基礎設施貧乏的大國也延伸至偏遠鄉村,而且他們正向利潤更高的品類積極擴張。

“Indofood is using noodles as a way to get cash flow now; they are not really trying to expand margins,” says Mr Teguh of CIMB. “The more lucrative growth will come from non-noodle businesses like beverages, dairy and restaurants.”

“印多福現在利用方便面作為獲取現金流的渠道,他們并不真想提高利潤率。”聯昌國際的Teguh說,“更有利可圖的增長將來自飲料、奶制品和餐館等方便面以外的業務部門。”