Drug firms and cancer Lucrative lifesavers

醫藥公司和癌癥 利潤豐厚的救星

The hopes and perils of betting on cancer treatments

癌癥治療的希望和風險

NEW weapons are emerging in the war on cancer.

在對癌癥的戰爭中不斷有新武器出現。

That is good news not just for patients but also for drug companies.

這不僅對病人是好消息,對制藥公司也是好消息。

The biggest ones, faced with falling sales as their existing medicines go off-patent, are investing in smaller firms with promising cancer treatments under development, hoping to secure the next blockbuster.

最先有藥物面臨著銷售下滑,失去專利保護,最重要的是投資于正在開發有前途的癌癥治療方法的小公司來確保擁有下一個重磅炸彈。

On August 25th Amgen, the world's biggest biotechnology company by sales, said it would pay $10.4 billion for another American firm, Onyx.

8月25日世界上最大的生物技術公司安進表示,它將支付104億美元收購Onyx公司。

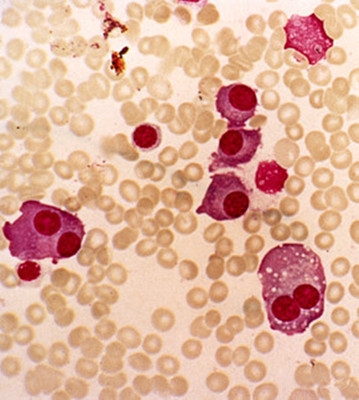

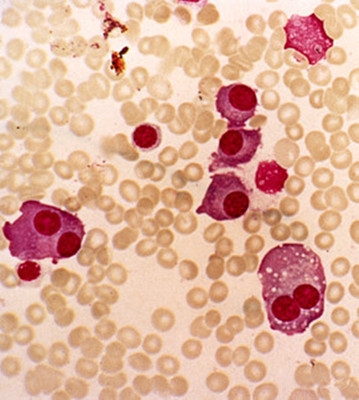

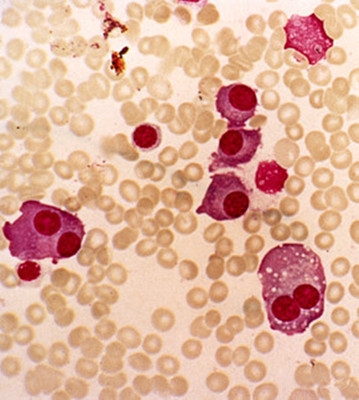

The target firm's crown jewel is Kyprolis, a treatment for multiple myeloma, a type of blood cancer.

該公司擁有的藥物Kyprolis能治療多發性骨髓瘤,一種類型的血癌。

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.

第二天,英國制藥公司阿斯利康稱將搶購Amplimmune公司,美國一家試圖通過激活免疫系統來治療癌癥的公司。

Oncology is attractive for several reasons.

腫瘤學有吸引力是因為以下幾個原因。

First, the understanding of cancer is evolving rapidly.

首先,對癌癥的了解在不斷加快。

In the 20th century treatment relied on surgery, radiation and chemotherapy.

在20世紀對癌癥的治療依賴于手術,放療和化療。

These now seem rudimentary.

現在這些都成了最基本的手段。

Immunotherapy—getting the immune system to attack cancer—has gone from theory into practice.

用免疫系統攻擊癌細胞已經從理論進入實踐。

Genomics has helped scientists target specific mutations that promote cancer.

基因組學幫助科學家通過特定的基因突變鎖定促使癌癥發生的基因。

Another area of excitement for cancer researchers is epigenetics, which alters how a gene acts without meddling with the sequence of DNA.

表觀遺傳學是癌癥研究的另一個令人興奮的領域,在不改變基因序列的前提下改變基因的表達。

Second, regulators have speeded up their approval of cancer drugs.

其次,監管機構已經在加快對抗癌藥物的市場準入。

Of the 39 medicines approved by America's Food and Drug Administration in 2012, 11 were for cancer.

在2012年由美國食品和藥物管理局批準的39種藥品中,有11種用于治療癌癥。

These included Kyprolis, which was granted accelerated approval, based on a smaller clinical trial than usual, for use as a last-ditch treatment for patients with multiple myeloma.

其中包括Kyprolis,在只進行了小規模的臨床試驗的基礎上加速審批通過,用于多發性骨髓瘤患者治療的最后一道防線。

Third, and most controversial, cancer drugs can fetch exorbitant prices, particularly in America.

第三,也是最有爭議的,治療癌癥的藥物可以賣高昂的價格,特別是在美國。

The idea is that there's nothing else available, so you can ask for a high price, explains Howard Liang of Leerink Swann, an investment bank.

美國醫療保健投資銀行的霍華德梁解釋說:我們的想法是,因為沒有別的可用,所以我們可以賣很高的價格。

A typical course of treatment with Kyprolis lasting, say, five months, can cost around $50,000.

使用Kyprolis治療一個療程,也就是5個月,花費大約5萬美元。

Little surprise, then, that big drugmakers are keen to develop their own cancer drugs, form partnerships with smaller firms that have promising treatments in the pipeline, and buy such companies outright.

有個小驚喜就是大制藥公司都熱衷于開發自己的抗癌藥物,與在治療過程中能提高治療效果的小公司形成合作關系,也直接收購這種小公司。

Kyprolis was first developed by a small firm called Proteolix, which was bought by Onyx, now acquired by Amgen.

首先Kyprolis是由一個叫 Proteolix的小公司開發的,被Onyx收購,現在又被Amgen收購。

In 2009 Bristol-Myers Squibb, an American drug giant, paid $2.4 billion for Medarex, which had an experimental immunotherapy drug.

美國制藥業巨頭施貴寶,2009年斥資24億美元收購了擁有免疫治療藥物的Medarex公司。

That drug, for melanoma, is now sold in America for $120,000 for a full course of treatment.

該藥物對黑色素瘤,現在在美國一個完整的療程需要12萬美元。

There are risks, however.

風險還是有的。

Even a drug seemingly destined for fame and fortune can fall flat.

即使藥物名利似乎注定落空。

The FDA has approved Kyprolis only for patients who have already tried at least two other treatments.

批準Kyprolis,只適用于那些已經嘗試過至少兩個其他治療方法的患者。

Its annual sales could reach $3 billion, reckons Goldman Sachs.

高盛估計其年銷售額能達到30億美元。

But that requires approval beyond America, and data showing that Kyprolis is worth giving to earlier-stage patients.

但是這還需要美國以外的批準,并且要有數據能夠證明Kyprolis也可以應用于早期患者。

AstraZeneca is buying Amplimmune largely for two cancer drugs still in early testing.

阿斯利康購買Amplimmune主要是兩種抗癌藥物目前仍處于早期測試。

If you are not willing to take risks, you cannot be in this area, says Bahija Jallal, an executive at AstraZeneca.

如果你不愿意承擔風險,你就不會出現在這個領域,阿斯利康的一個管理人員Bahija Jallal說。

The biggest question in the long term is whether health insurers and governments will keep paying up.

長期來看最大的問題是醫療保險公司和政府是否會繼續支持。

Onyx and Bayer, a German firm, share the profits of Nexavar, a kidney-cancer drug.

德國拜耳公司和Onyx共享腎癌藥物多吉美的利潤。

Last year Indian regulators granted a local firm a compulsory licence to sell Nexavar copies for a fraction of Bayer's price.

去年印度的監管機構強制許可授予當地一家小公司銷售多吉美的仿制藥,價格只是拜耳的一小部分。

The response elsewhere is less extreme.

其他地方的響應卻不那么極端。

But companies face new scrutiny over their prices, particularly in Europe.

但是,公司在歐洲面臨新的價格審查。

In April more than 100 experts in chronic myeloid leukaemia signed a paper to protest against the high cost of drugs.

4月100多名在慢性髓性白血病方面的專家簽署了一份抗議藥物成本過高的聲明。

For now, however, Amgen should be able to continue charging handsomely for Kyprolis.

但就目前而言,安進能夠從Kyprolis獲得豐厚的利潤。

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.

The next day AstraZeneca, a British drugs firm, said it would snap up Amplimmune, an American firm working on ways to trigger the immune system to fight cancer.