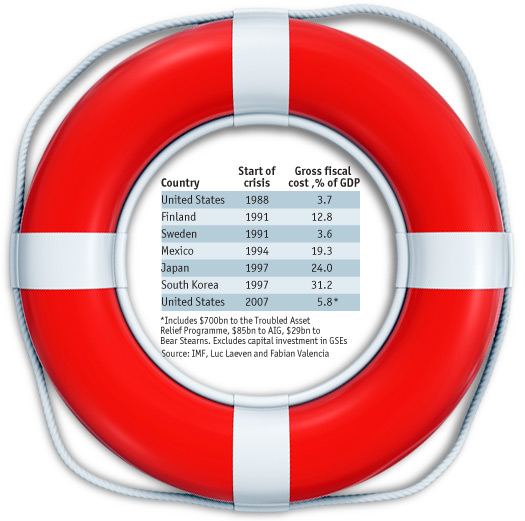

The price of safety

安全的代價(jià)

How much have previous bail-outs cost?

以前的救市計(jì)劃花費(fèi)多少?

CONGRESS is under pressure to approve the Treasury’s proposed $700 billion rescue package. Lawmakers, however, are conscious of the cost to the taxpayer: together with loans to AIG and Bear Stearns, public backing so far approaches 6% of GDP. This is well above the 3.7% of GDP of the savings-and-loan bail-out in the late 1980s and early 1990s. But some 6% of GDP is still much less than the average cost of resolving banking crises around the world in the past three decades, which a study by Luc Laeven and Fabian Valencia, of the IMF, puts at 16%.

目前國(guó)會(huì)正面臨壓力,要求它通過(guò)財(cái)政部提出的7000億美元的救市計(jì)劃。不過(guò),立法者們意識(shí)到了納稅人需要承擔(dān)的代價(jià):算上提供給AIG和貝爾斯登的貸 款,目前此次金融危機(jī)中的公共支出已經(jīng)接近GDP的6%。而1980年代末和1990年代初發(fā)生儲(chǔ)蓄信貸機(jī)構(gòu)危機(jī)時(shí),這一數(shù)字不過(guò)為3.7%。但是,根據(jù) 國(guó)際貨幣基金組織Luc Laeven 和 Fabian Valencia的一項(xiàng)研究,過(guò)去三十年來(lái)世界為解決銀行危機(jī)的公共支出占GDP的份額平均為16%。6%仍遠(yuǎn)低于這一平均值。